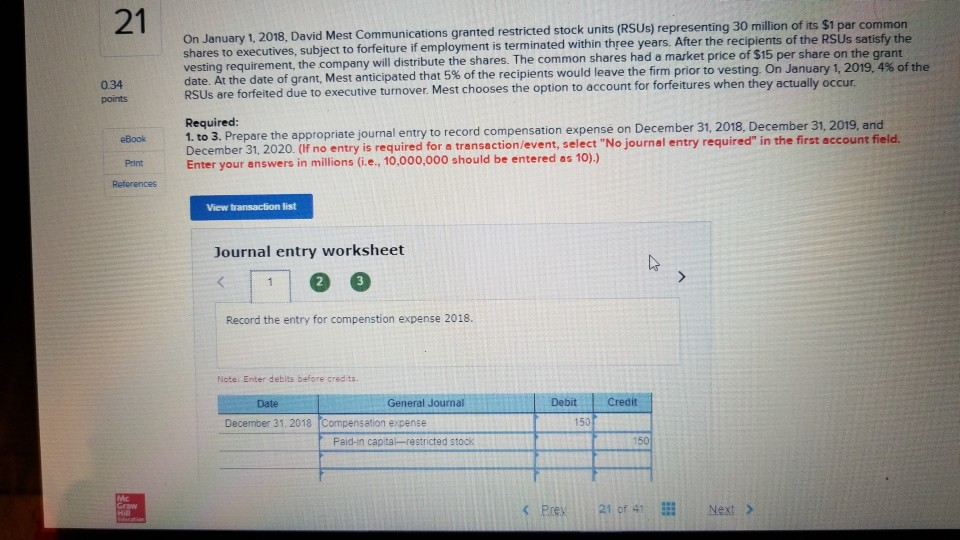

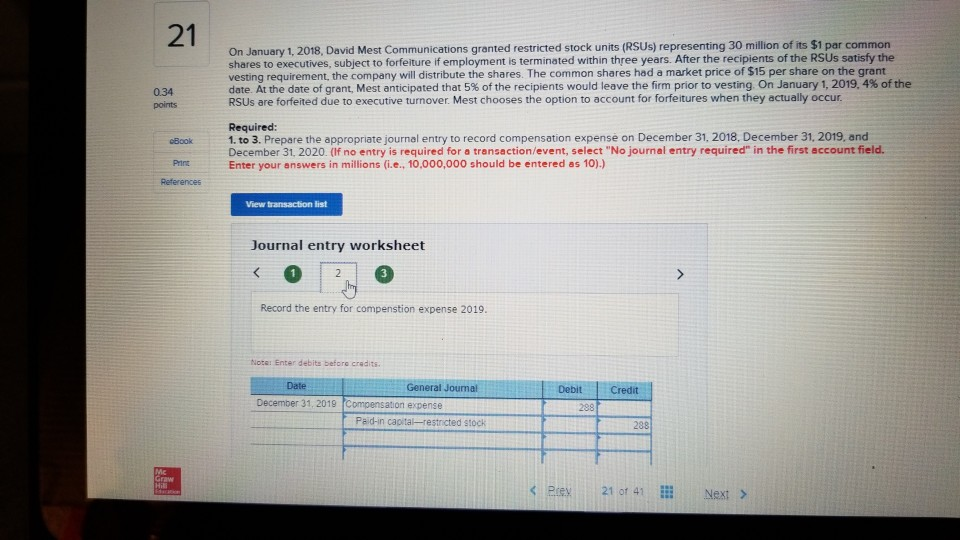

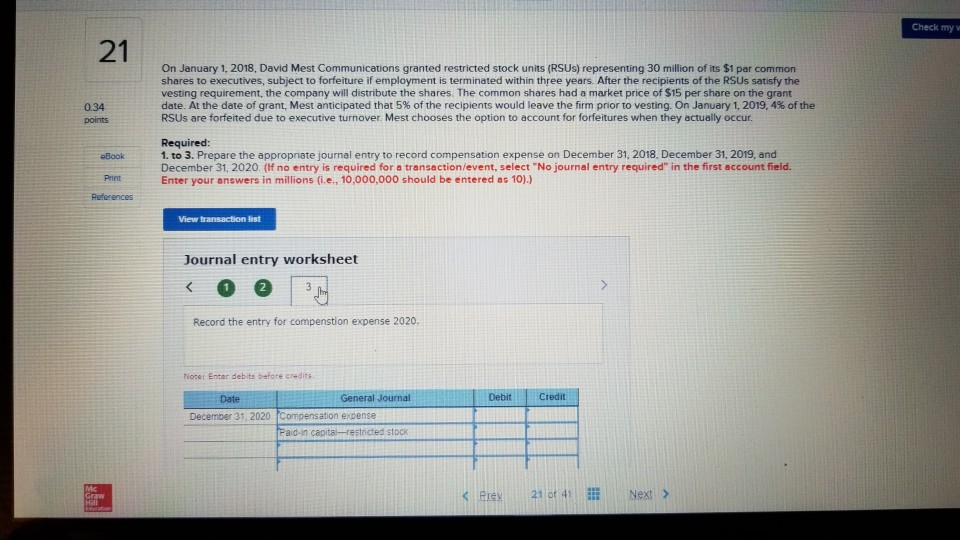

Question: please solve this correctly and show how you get the values 21. I got the values wrong for part 2. dont know what i did

please solve this correctly and show how you get the values 21.

I got the values wrong for part 2. dont know what i did wrong. I used to correct formula.

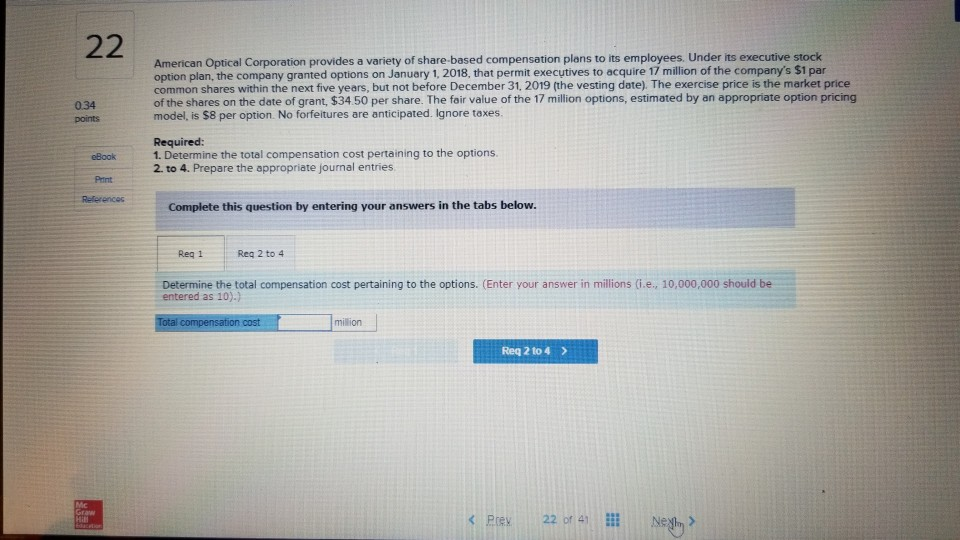

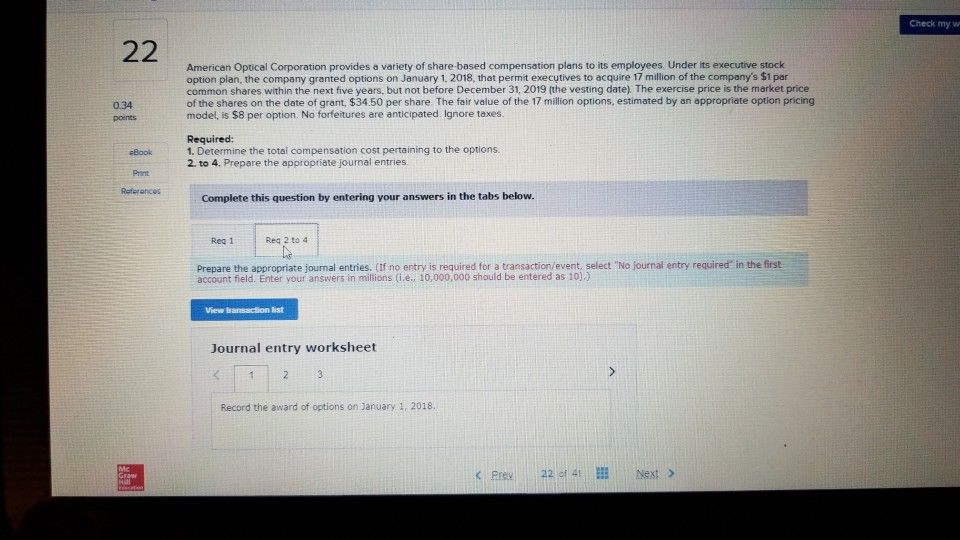

22.

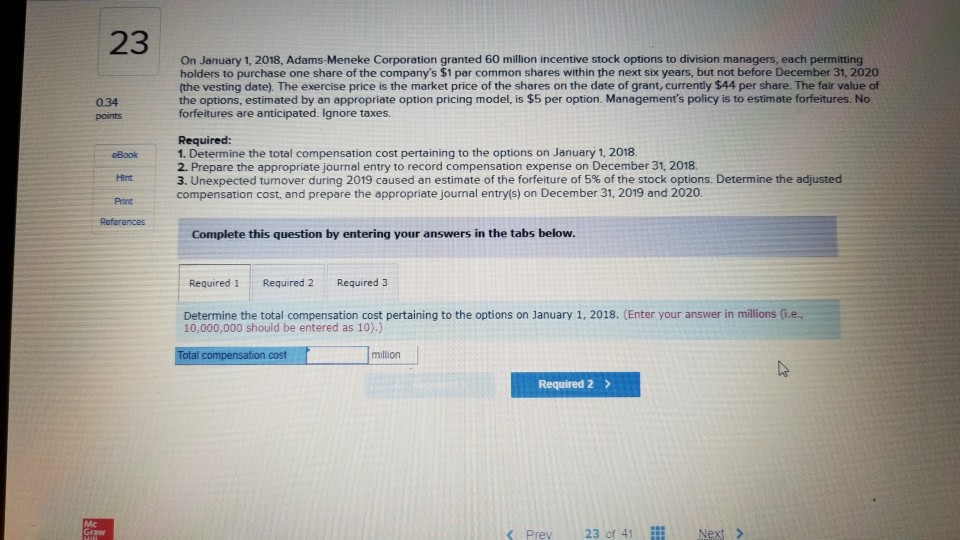

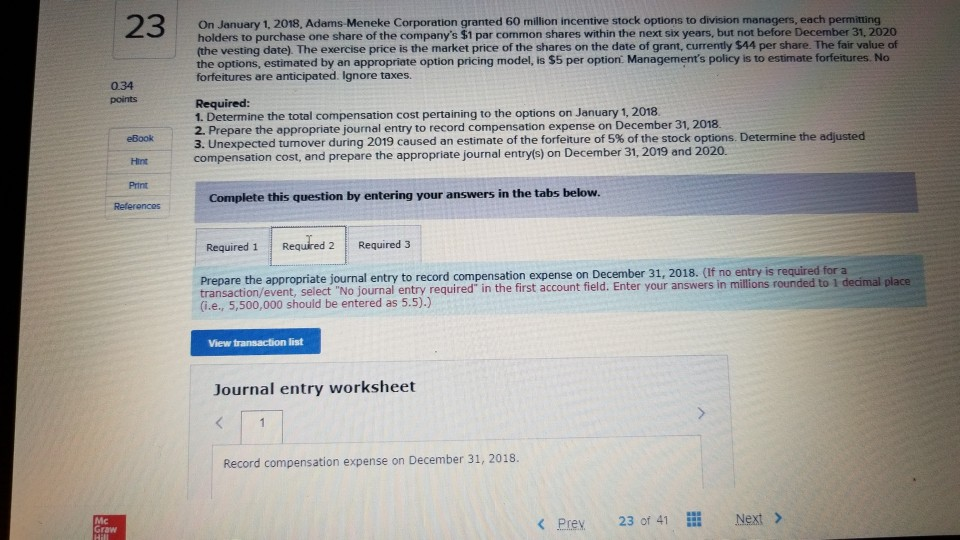

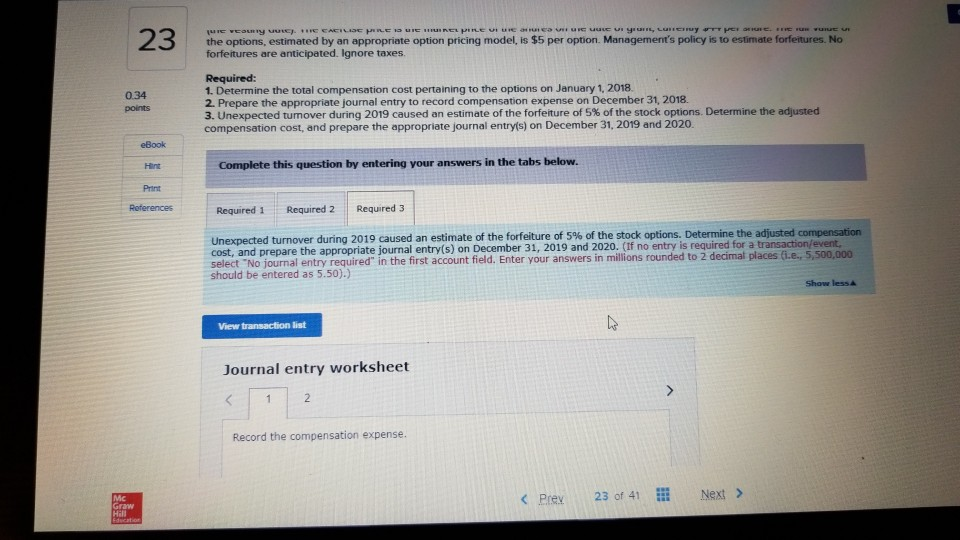

23.

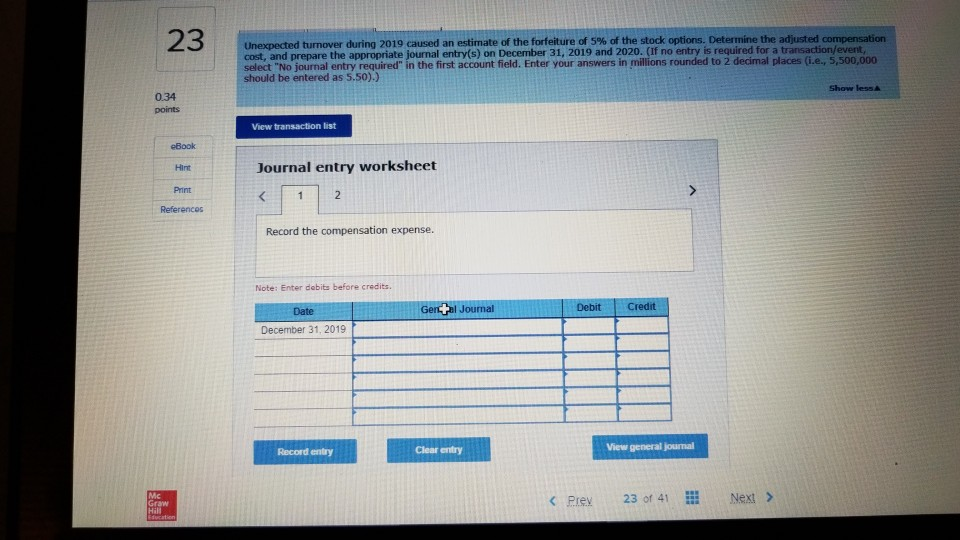

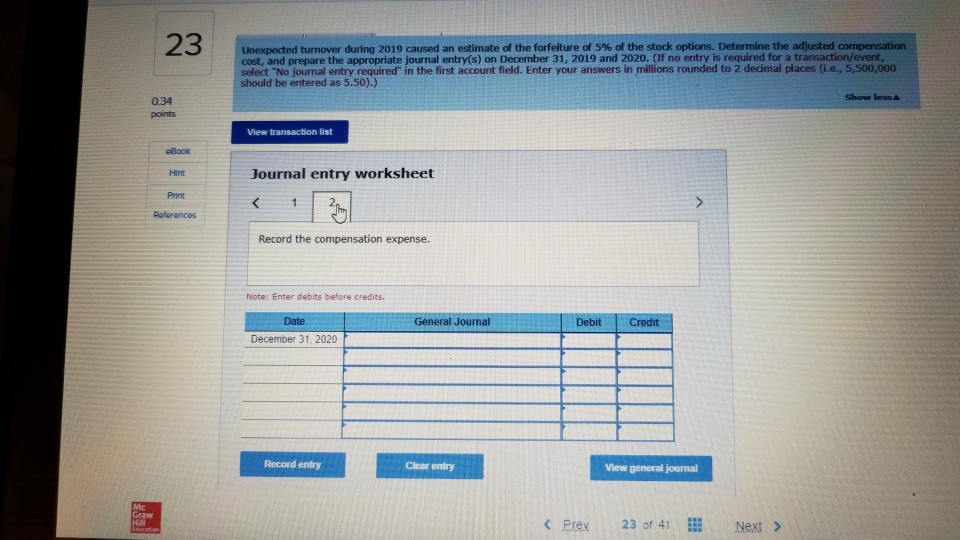

Communications granted restricted stock units (RSUs) representing 30 million of its $1 par common the recipients of the RSUs satisfy the On January 1, 2018, David Mest shares to executives, subject to forfeiture if employment is terminated within three years. After vesting requirement, the company will distribute the shares. The common shares had a market date. At the date of grant, Mest anticipated that 5% of the recipients would leave the firm prior to RSUs are forfeited due to executive turnover. price of $15 per share on the grant vesting. On January 1, 2019, 4% of the 0.34 points Mest chooses the option to account for forfeitures when they actually occur Required: 1. to 3. Prepare the appropriate journal entry to record compensation expense on Decem December 31, 2020. (If no entry is required for a transaction/event, select "No journal entry required" in the first account ber 31, 2018, December 31, 2019, and Print Enter your answers in millions (i.e,, 10,000,000 should be entered as 10)) View transaction list Journal entry worksheet Record the entry for compenstion expense 2018. Note. Enter debits before credits. General Journal Debit Credit Date December 31, 2018 Compensation expense 150 Paid-in capital-restricted stock 50 On January 1, 2018, David Mest Communications granted restricted stock units (RSUs) representing 30 million of its $1 par common shares to executives, subject to forfeiture if employment is terminated within three years. After the recipients of the RSUs satisfy the vesting requirement, the company will distribute the shares. The common shares had a market price of $15 per share on the grant date At the date of grant, Mest anticipated that 5% of the recipients would leave the firm prior to vesting. On January 1, 2019,4% of the RSUs are forfeited due to executive turnover. Mest chooses the option to account for forfeitures when they actually occur 0.34 points Required: oBook 1. to 3. Prepare the appropriate journal entry to record compensation expense on December 31, 2018, December 31, 2019, and December 31, 2020. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10) Print References View transaction list Journal entry worksheet Record the entry for compenstion expense 2019 Noter Enter debits before cradits. Date General Journal Debit Credit December 31, 2019 Compensation expense Paid-in capital-resticted stock 288 K Pey 21 of 41 l Next > Check my w On January 1, 2018, David Mest Communications granted restricted stock units (RSUs) representing 30 million of its $1 par common shares to executives, subject to forfeiture if employment is terminated within three years. After the recipients of the RSUs satisfy the vesting requirement, the company will distribute the shares. The common shares had a market price of $15 per share on the grant date. At the date of grant Mest anticipated that 5% of the recipients would leave the firm prior to vesting. On January ,2019, 4% of the RSUs are forfeited due to executive turnover. Mest chooses the option to account for forfeitures when they actually occur 0.34 points Required: 1to 3. Prepare the appropriate journal entry to record compensation expense on December 3, 208, December 3, 2019,and December 31, 2020. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10 eBook Pint View transaction list Journal entry worksheet Record the entry for compenstion expense 2020. Noter Enter debits before credits Date neral Jourmal Debit Credit Decemiber 31, 2020 expense aid-in capital- restricted stock erey i 21 of 41 | Next > American Optical Corporation provides a variety of share-based compensation plans to its employees. Under its executive stock option plan, the company granted options on January 1, 2018, that permit executives to acquire 17 million of the company's $1 par common shares within the next five years, but not before December 31, 2019 (the vesting date). The exercise price is the market price of the shares on the date of grant, $34 50 per share. The fair value of the 17 million options, estimated by an appropriate option pricing model, is $8 per option. No forfeitures are anticipated. Ignore toxes 034 points Required: eBook1. Determine the total compensation cost pertaining to the options. 2 to 4. Prepare the appropriate journal entries Print References Complete this question by entering your answers in the tabs below Req 1Req 2 to 4 Determine the total compensation cost pertaining to the options. (Enter your answer in millions (i.e., 10,000,000 should b entered as 10).) cost Req 2 to 4> Check my w American Optical Corporation provides a variety of share-based compensation plans to its employees Under its executive stock option plan, the company granted options on January 1, 2018, that permit executives to acquire 17 million of the company's $1 par common shares within the next five years, but not before December 31, 2019 (the vesting date) The exercise price is the market price of the shares on the date of grant, $34.50 per share. The fair value of the 17 million options, estimated by an appropriate option pricing 0.34 points Required: 1. Determine the total compensation cost pertaining to the options. 2. to 4. Prepare the appropriate journal entries eBook Print References Complete this question by entering your answers in the tabs below. Re 1 Req 2 to a4 Prepare the appropriate journal entries. (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10) Journal entry worksheet Record the award of options on January 1, 2018 Pre22 of 41 Next > On January 1, 2018, Adams-Meneke Corporation granted 60 million incentive stock options to division managers, each permitting holders to purchase one share of the company's $1 par common shares within the next six years, but not before December 31, 2020 the vesting date). The exercise price is the market price of the shares on the date of grant, currently $44 per share. The fair value of the options, estimated by an appropriate option pricing model, is $5 per option. Management's policy is to estimate forfeitures. No forfeitures are anticipated. Ignore taxes. 0.34 points eBook Hint Print 1. Determine the total compensation cost pertaining to the options on January 1, 2018. 2. Prepare the appropriate journal entry to record compensation expense on December 31, 2018. 3. Unexpected turnover during 2019 caused an estimate of the forfeiture of 5% of the stock options. Determine the adjusted compensation cost, and prepare the appropriate journal entryls) on December 31, 2019 and 2020 Complete this question by entering your answers in the tabs belovw Required 1Required 2 Required 3 Determine the total compensation cost pertaining to the options on January 1, 2018. (Enter your answer in millions (i.e. 10,000,000 should be entered as 10).) million Required 2 K Prev 23 of 41 On January 1, 2018, Adams-Meneke Corporation granted 60 million incentive stock options to division managers, each permitting holders to purchase one share of the company's $1 par common shares within the next six years, but not before December3.2D2 (the vesting date) The exercise price is the market price of the shares on the date of grant, currently $44 per share. The fair value of the options, estimated by an appropriete option pricing model, is $5 per option Management's policy is to estimate forfeitures. No forfeitures are anticipated. Ignore taxes. 0.34 points 1. Determine the total compensation cost pertaining to the options on January 1, 2018 2. Prepare the appropriate journal entry to record compensation expense on December 31. 2018 3. Unexpected turnover during 2019 caused an estimate of the forfeiture of 5% of the stock options. Determine the adjusted compensation cost, and prepare the appropriate journal entry(s) on December 31, 2019 and 2020. eBook Hint Print References tabs below. Complete this question by entering your answers in the Required 1 Reequired 3 Prepare the appropriate journal entry to record compensation expense on December 31, 2018. (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Enter your answers in millions rou G.e., 5,500,000 should be entered as 5.5).) View transaction list Journal entry worksheet Record compensation expense on December 31, 2018. Mc Graw Prey 23 of 41 Next> 23 Unexpected turnover during 2019 caused an estimate of the forfeiture of 5% of the stock options. Determine the adjusted cost, and prepare the appropriate journal entry(s) on December 31, 2019 and 2020. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.50).) Show less 0.34 points View transaction list eBook Hint Print Journal entry worksheet Record the compensation expense Note: Enter debits before credits. Debit Credit December 31, 2019 Record entry Clear entry View general journal Mc Graw lev 23 of 41 Next > 23 turnover during 2019 caused an estimate of the forfeiture of 5% ofthe stock options. Determine the adjusted cost, and prepare the appropriate journal entry(s) on December 31, 2019 and 2020. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.50).) Show less 034 points View transaction list Journal entry worksheet Hint Print Roferences Record the compensation expense. Note: Enter debits before credits, Date General Journal Debit Credit December 31, 2020 Record entry Clear entry View general journal Mc Graw <.rlex of next>

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts