Question: Please solve this Financial Engineering question. Thanks in advance! Problem 3. ( 40 pts) Consider the Black Scholes model (1). The goal of the exercise

Please solve this Financial Engineering question. Thanks in advance!

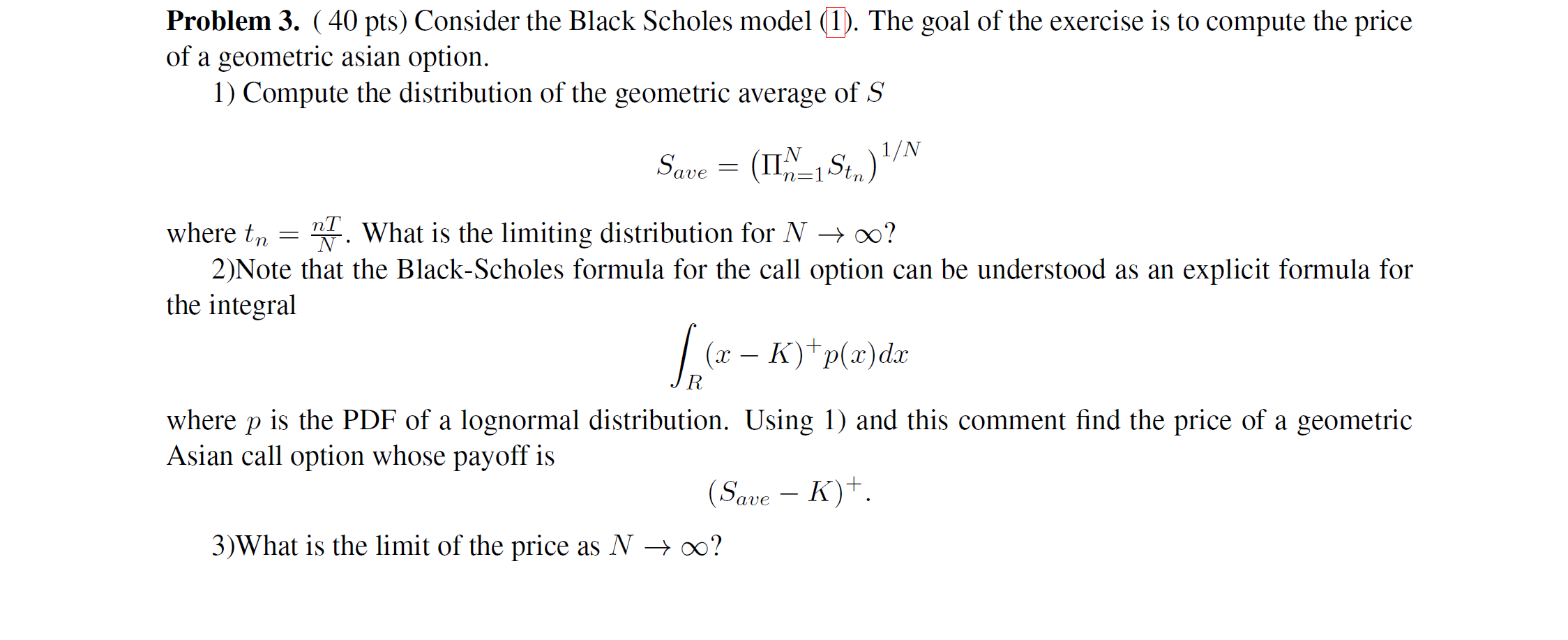

Problem 3. ( 40 pts) Consider the Black Scholes model (1). The goal of the exercise is to compute the price of a geometric asian option. 1) Compute the distribution of the geometric average of S' Save = (IIn=1St ) 1/N where tn = 24. What is the limiting distribution for N -> co? 2)Note that the Black-Scholes formula for the call option can be understood as an explicit formula for the integral (x - K)+p(x) dac R where p is the PDF of a lognormal distribution. Using 1) and this comment find the price of a geometric Asian call option whose payoff is (Save - K) +. 3)What is the limit of the price as N - co

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts