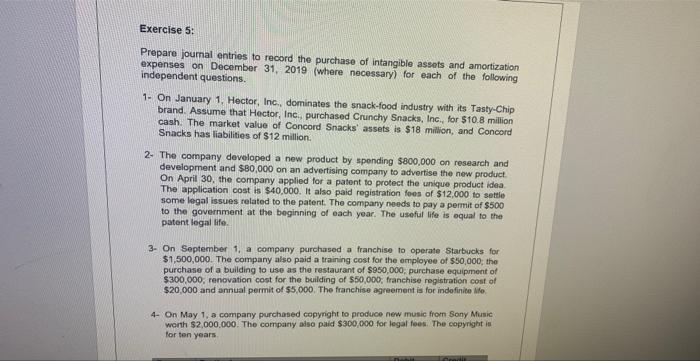

Question: PLEASE SOLVE THIS QUESTION Exercise 5: Prepare joumal entries to record the purchase of intangible assets and amortization expenses on December 31, 2019 (where necessary)

Exercise 5: Prepare joumal entries to record the purchase of intangible assets and amortization expenses on December 31, 2019 (where necessary) for each of the following independent questions. 1. On January 1, Hector, Inc, dominates the snack-food industry with its Tasty-Chip brand. Assume that Hector, Inc., purchased Crunchy Snacks, Inc. for $10.8 million cash. The market value of Concord Snacks' assets is $18 million, and Concord Snacks has liabilities of $12 million. 2. The company developed a new product by spending $800,000 on research and development and $80,000 on an advertising company to advertise the new product. On April 30, the company applied for a patent to protect the unique product idea The application cost is $40,000. It also paid registration foes of $12,000 to settle some legal issues related to the patent. The company needs to pay a permit of $500 to the government at the beginning of each year. The usoful life is oqual to the patent legal life. 3. On September 1, a compary purchased a franchise to operate Starbucks for $1,500,000. The company also paid a training cost for the omployee of 550,000 ; the purchase of a building to use as the restaurant of $950,000, purchase equipment of $300,000; renovation cost for the building of $50,000, franchise registration cost of $20,000 and annual permit of $5,000. The franchise agreement is for indofinice Mo. 4- On May 1, a company purchased copynight to produce new music from Sany Music worth $2,000,000. The compary adso paid $300,000 for legal fees. The copyright is for ten years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts