Question: PLEASE SOLVE THIS QUESTION Exercise 6: Prepare journal entries to record the purchase of Natural Resources and depletion expenses on December 31,2019 , for each

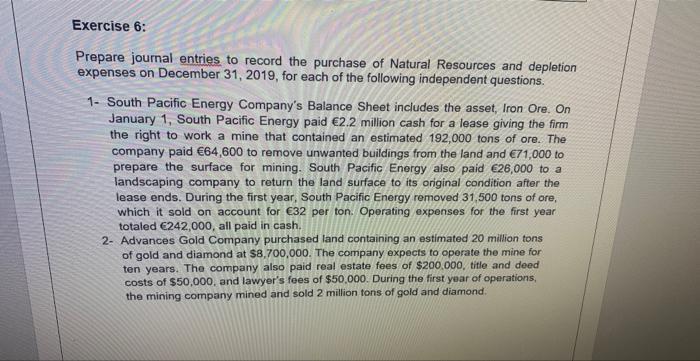

Exercise 6: Prepare journal entries to record the purchase of Natural Resources and depletion expenses on December 31,2019 , for each of the following independent questions. 1- South Pacific Energy Company's Balance Sheet includes the asset, Iron Ore, On January 1 , South Pacific Energy paid 2.2 million cash for a lease giving the firm the right to work a mine that contained an estimated 192,000 tons of ore. The company paid 64,600 to remove unwanted buildings from the land and 71,000 to prepare the surface for mining. South Pacific Energy also paid 626,000 to a landscaping company to return the land surface to its original condition after the lease ends. During the first year, South Pacific Energy removed 31,500 tons of ore, which it sold on account for 632 per ton. Operating expenses for the first year totaled 6242,000 , all paid in cash. 2- Advances Gold Company purchased land containing an estimated 20 million tons of gold and diamond at $8,700,000. The company expects to operate the mine for ten years. The company also paid real estate fees of $200.000, title and deed costs of $50,000. and lawyer's fees of $50,000. During the first year of operations, the mining company mined and sold 2 million tons of gold and diamond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts