Question: Please solve using Excel Linear Programming and Solver 12.02-PR002 Aerotron Radio Inc, has $250,000 available and its enginee 5 years and have its initial investment

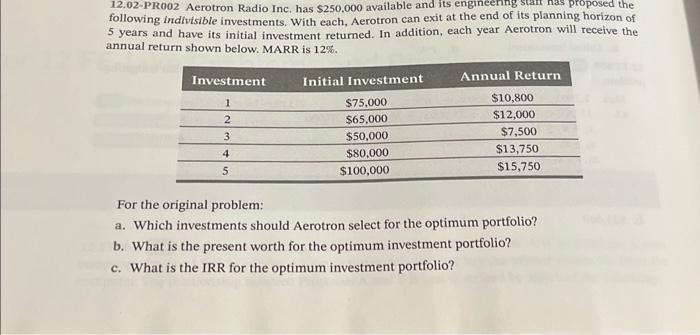

12.02-PR002 Aerotron Radio Inc, has $250,000 available and its enginee 5 years and have its initial investment returned. In addition, each year Aerotron will receive the annual return shown below. MARR is 12%. For the original problem: a. Which investments should Aerotron select for the optimum portfolio? b. What is the present worth for the optimum investment portfolio? c. What is the IRR for the optimum investment portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts