Question: Please solve using Mircrosoft Excel A real estate developer seeks to determine the most economical height for a new office building, which will be sold

Please solve using Mircrosoft Excel

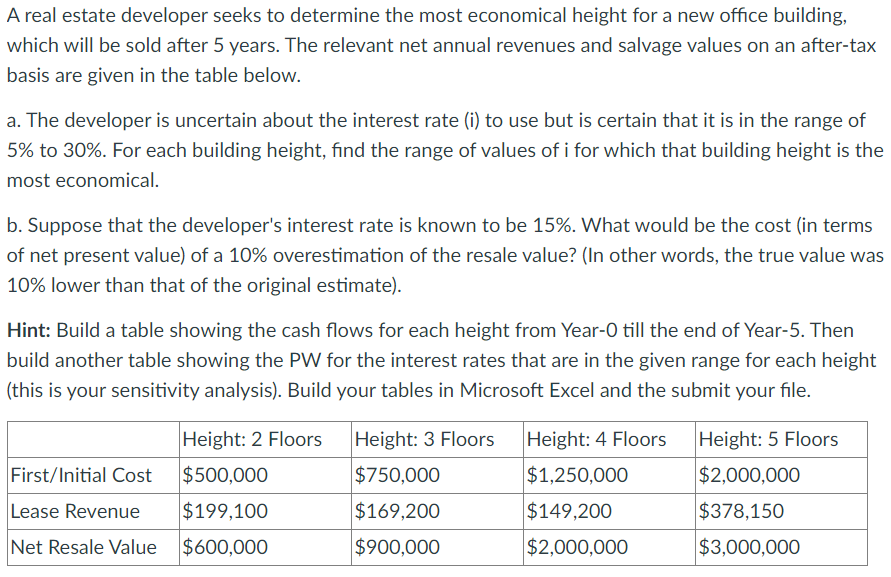

A real estate developer seeks to determine the most economical height for a new office building, which will be sold after 5 years. The relevant net annual revenues and salvage values on an after-tax basis are given in the table below. a. The developer is uncertain about the interest rate (i) to use but is certain that it is in the range of 5% to 30%. For each building height, find the range of values of i for which that building height is the most economical. b. Suppose that the developer's interest rate is known to be 15%. What would be the cost (in terms of net present value) of a 10% overestimation of the resale value? (In other words, the true value was 10% lower than that of the original estimate). Hint: Build a table showing the cash flows for each height from Year-0 till the end of Year-5. Then build another table showing the PW for the interest rates that are in the given range for each height (this is your sensitivity analysis). Build your tables in Microsoft Excel and the submit your file

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts