Question: Please solve with excel and show formulas! thanks! Use simple interest rate method and Actual/365 day count for all exercises below. Lesson 4 Exercise 2:

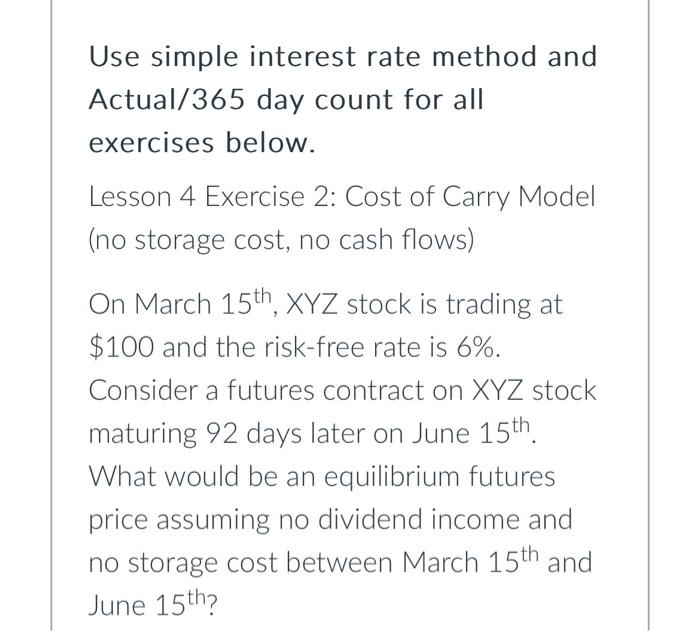

Use simple interest rate method and Actual/365 day count for all exercises below. Lesson 4 Exercise 2: Cost of Carry Model (no storage cost, no cash flows) On March 15th,XYZ stock is trading at $100 and the risk-free rate is 6%. Consider a futures contract on XYZ stock maturing 92 days later on June 15th. What would be an equilibrium futures price assuming no dividend income and no storage cost between March 15th and June 15th

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts