Question: Please solve WITHOUT USING EXCEL. Show all work. Thank you! The company you work for is trying to decide between two projects. Project 1 costs

Please solve WITHOUT USING EXCEL. Show all work. Thank you!

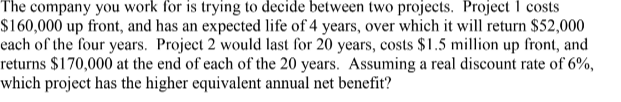

The company you work for is trying to decide between two projects. Project 1 costs $160,000 up front, and has an expected life of 4 years, over which it will return $52,000 each of the four years. Project 2 would last for 20 years, costs $1.5 million up front, and returns $170,000 at the end of each of the 20 years. Assuming a real discount rate of 6%, which project has the higher equivalent annual net benefit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts