Question: please someone help me understand this and help me solve PROBLEM-Scott Smith started Smith Architectural Services on May 1, 2022. During May the business completed

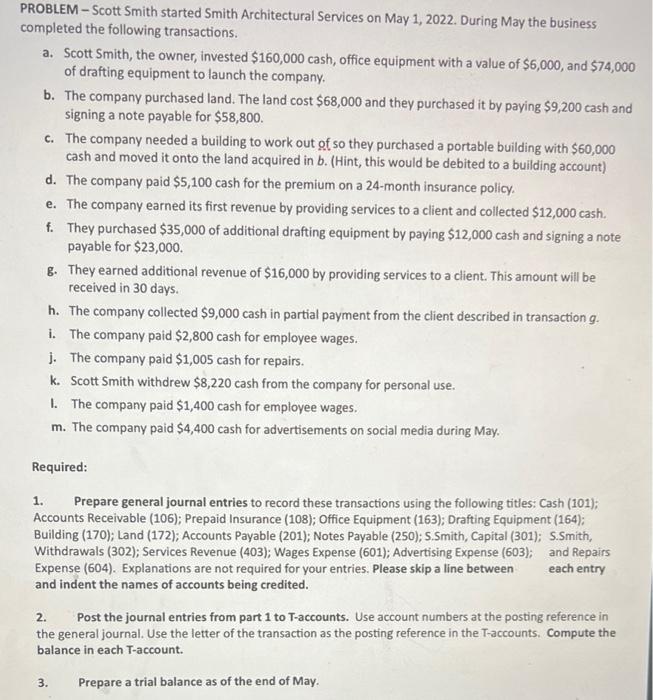

PROBLEM-Scott Smith started Smith Architectural Services on May 1, 2022. During May the business completed the following transactions. a. Scott Smith, the owner, invested $160,000 cash, office equipment with a value of $6,000, and $74,000 of drafting equipment to launch the company. b. The company purchased land. The land cost $68,000 and they purchased it by paying $9,200 cash and signing a note payable for $58,800. c. The company needed a building to work out of so they purchased a portable building with $60,000 cash and moved it onto the land acquired in b. (Hint, this would be debited to a building account) d. The company paid $5,100 cash for the premium on a 24-month insurance policy. e. The company earned its first revenue by providing services to a client and collected $12,000 cash. f. They purchased $35,000 of additional drafting equipment by paying $12,000 cash and signing a note payable for $23,000. g. They earned additional revenue of $16,000 by providing services to a client. This amount will be received in 30 days. h. The company collected $9,000 cash in partial payment from the client described in transaction g. i. The company paid $2,800 cash for employee wages. j. The company paid $1,005 cash for repairs. k. Scott Smith withdrew $8,220 cash from the company for personal use. I. The company paid $1,400 cash for employee wages. m. The company paid $4,400 cash for advertisements on social media during May. Required: 1. Prepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106); Prepaid Insurance (108); Office Equipment (163); Drafting Equipment (164); Building (170); Land (172); Accounts Payable (201); Notes Payable (250); S.Smith, Capital (301); S.Smith, Withdrawals (302); Services Revenue (403); Wages Expense (601); Advertising Expense (603); and Repairs Expense (604). Explanations are not required for your entries. Please skip a line between each entry and indent the names of accounts being credited. 2. Post the journal entries from part 1 to T-accounts. Use account numbers at the posting reference in the general journal. Use the letter of the transaction as the posting reference in the T-accounts. Compute the balance in each T-account. 3. Prepare a trial balance as of the end of May

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts