Question: Please state each steps clearly. Thank you so much for helping. Question 15 Smith is currently 45 years old and her spouse is 55 years

Please state each steps clearly. Thank you so much for helping.

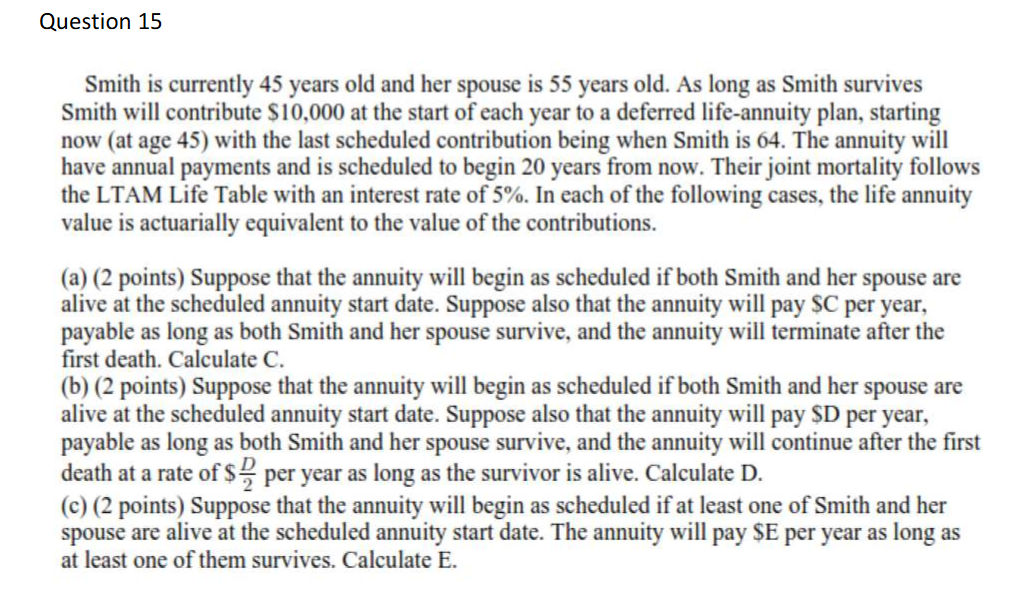

Question 15 Smith is currently 45 years old and her spouse is 55 years old. As long as Smith survives Smith will contribute 5 [0.000 at the start of each year to a deferred lifemnuity plan. starting now (at age 45) with the last scheduled contribution being when Smith is 04. The annuity will have annual payments and is scheduled to begin 20 years from now. \"their joint mortality follows the LTAM Life Table with an interest rate of 5%. In each of the following cases, the life annuity value is actuarially equivalent to the value of the contributions. (a) (2 points) Suppose that the annuity will begin as scheduled if both Smith and her spouse are alive at the scheduled annuity start date. Suppose also that the annuity will pay SC per year. payable as long as both Smith and her spouse survive. and the annuity will terminate after the rst death. Calculate C. (b) (2 points) Suppose that the annuity will begin as scheduled if both Smith and her spouse are alive at the scheduled annuity start date. Suppose also that the annuity will pay SD per year, payable as long as both Smith and her spouse survive, and the annuity will continue after the rst death at a rate of $% per year as long as the survivor is alive. Calculate D. (c) (2 points) Suppose that the annuity will begin as scheduled if at least one of Smith and her spouse are alive at the scheduled annuity start date. The annuity will pay 5E per year as long as at least one of them smvives. Calculate E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts