Question: Please take your time to answer this question based off the information I provided you in the screen shot. Please take your time and complete

Please take your time to answer this question based off the information I provided you in the screen shot. Please take your time and complete this question to the best of your ability for a thumbs up. Thank you!

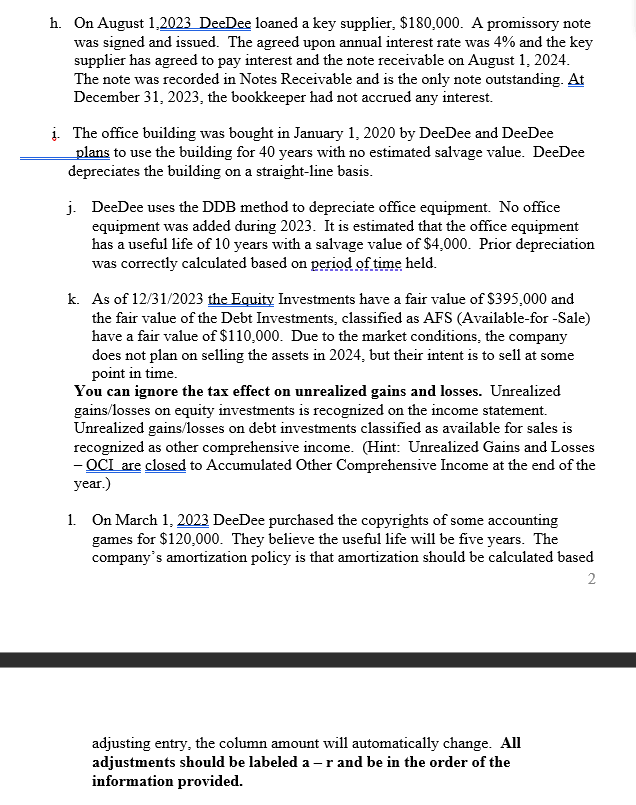

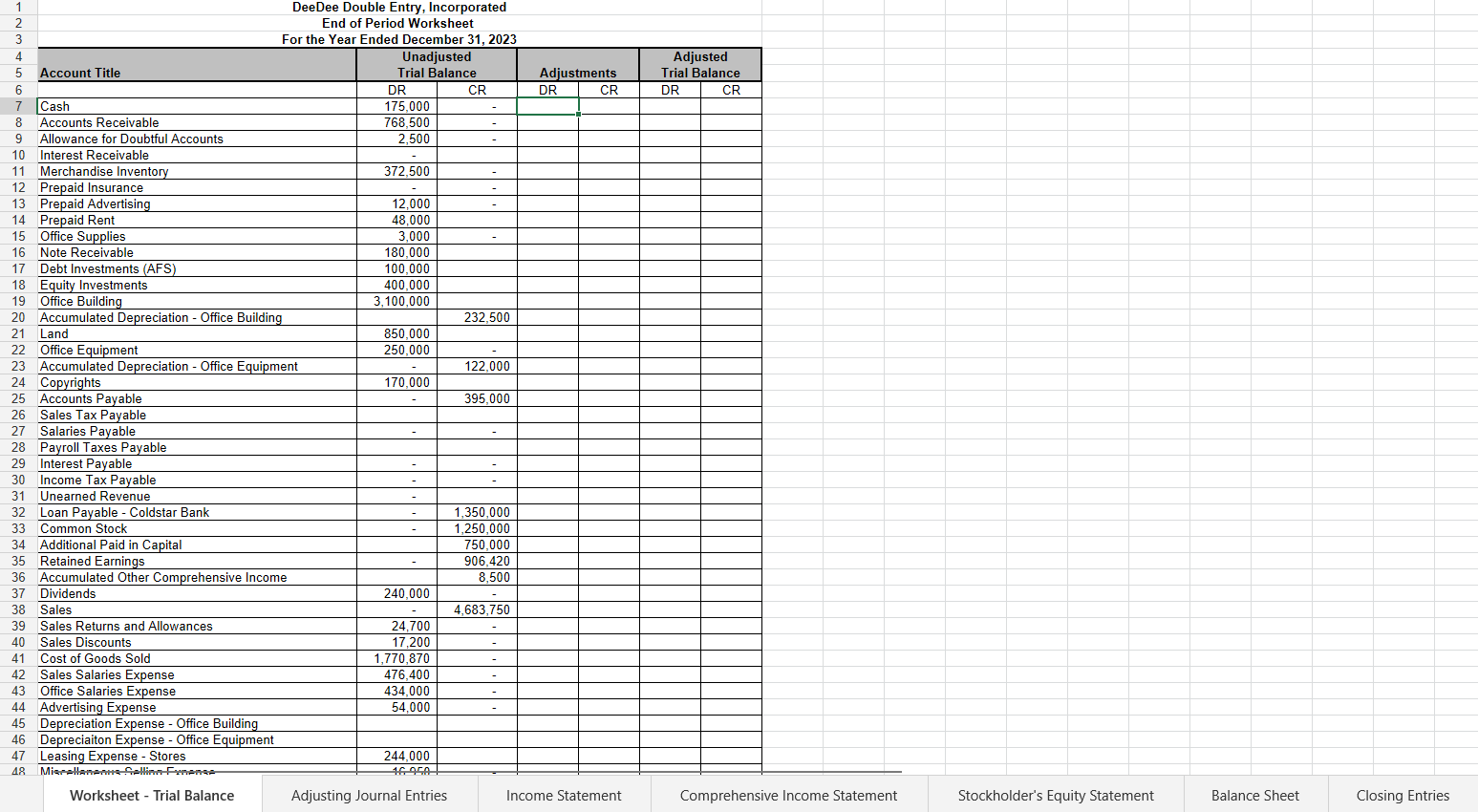

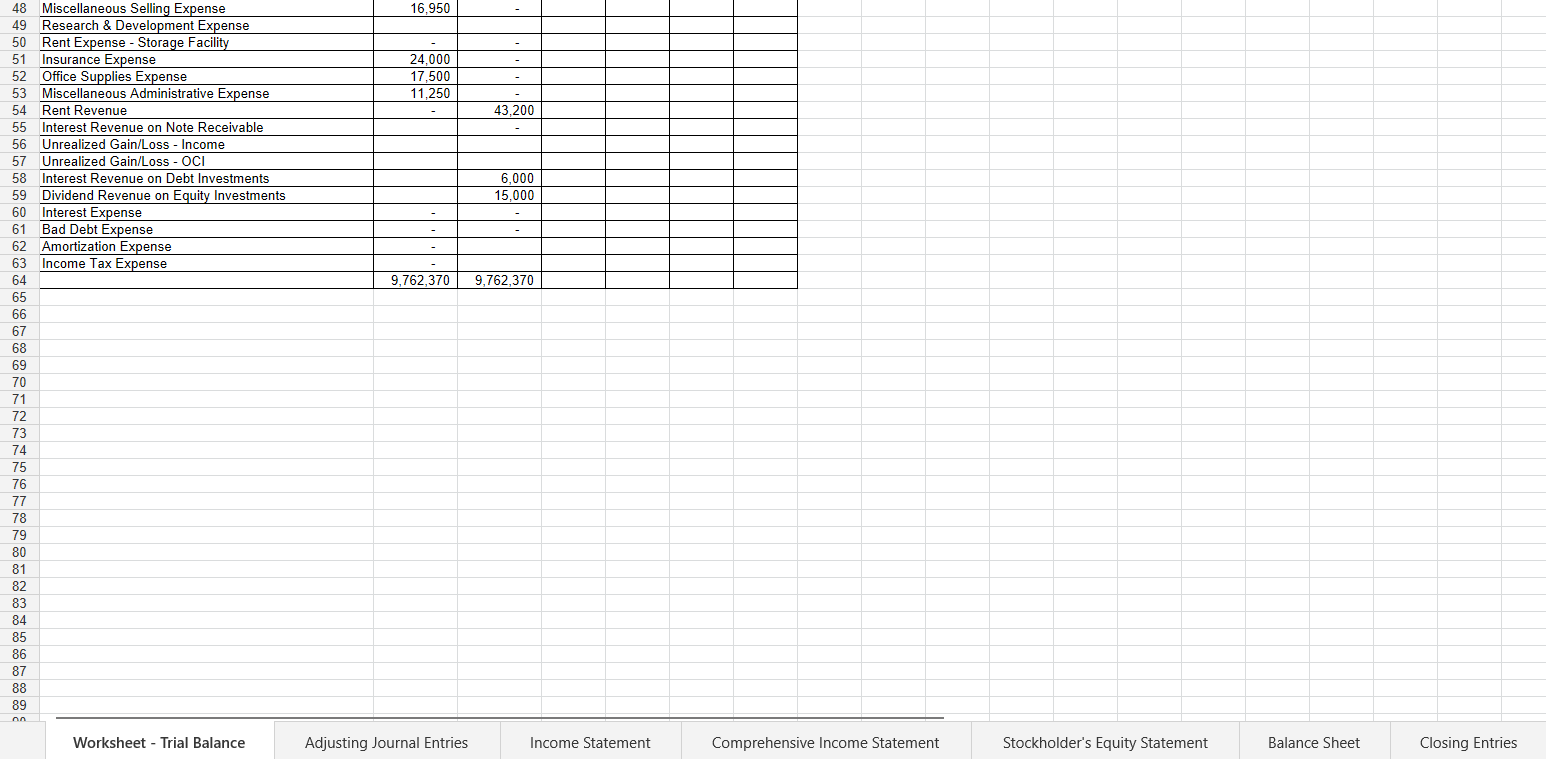

h. On August 1,2023 DeeDee loaned a key supplier, $180,000. A promissory note was signed and issued. The agreed upon annual interest rate was 4% and the key supplier has agreed to pay interest and the note receivable on August 1, 2024. The note was recorded in Notes Receivable and is the only note outstanding. At December 31, 2023, the bookkeeper had not accrued any interest. i. The office building was bought in January 1, 2020 by DeeDee and DeeDee plans to use the building for 40 years with no estimated salvage value. DeeDee depreciates the building on a straight-line basis. j. DeeDee uses the DDB method to depreciate office equipment. No office equipment was added during 2023. It is estimated that the office equipment has a useful life of 10 years with a salvage value of $4,000. Prior depreciation was correctly calculated based on period of time held. k. As of 12/31/2023 the Equity Investments have a fair value of $395,000 and the fair value of the Debt Investments, classified as AFS (Available-for-Sale) have a fair value of $110,000. Due to the market conditions, the company does not plan on selling the assets in 2024 , but their intent is to sell at some point in time. You can ignore the tax effect on unrealized gains and losses. Unrealized gains/losses on equity investments is recognized on the income statement. Unrealized gains/losses on debt investments classified as available for sales is recognized as other comprehensive income. (Hint: Unrealized Gains and Losses - OCI are closed to Accumulated Other Comprehensive Income at the end of the year.) 1. On March 1, 2023 DeeDee purchased the copyrights of some accounting games for $120,000. They believe the useful life will be five years. The company's amortization policy is that amortization should be calculated based 2 adjusting entry, the column amount will automatically change. All adjustments should be labeled ar and be in the order of the information provided. h. On August 1,2023 DeeDee loaned a key supplier, $180,000. A promissory note was signed and issued. The agreed upon annual interest rate was 4% and the key supplier has agreed to pay interest and the note receivable on August 1, 2024. The note was recorded in Notes Receivable and is the only note outstanding. At December 31, 2023, the bookkeeper had not accrued any interest. i. The office building was bought in January 1, 2020 by DeeDee and DeeDee plans to use the building for 40 years with no estimated salvage value. DeeDee depreciates the building on a straight-line basis. j. DeeDee uses the DDB method to depreciate office equipment. No office equipment was added during 2023. It is estimated that the office equipment has a useful life of 10 years with a salvage value of $4,000. Prior depreciation was correctly calculated based on period of time held. k. As of 12/31/2023 the Equity Investments have a fair value of $395,000 and the fair value of the Debt Investments, classified as AFS (Available-for-Sale) have a fair value of $110,000. Due to the market conditions, the company does not plan on selling the assets in 2024 , but their intent is to sell at some point in time. You can ignore the tax effect on unrealized gains and losses. Unrealized gains/losses on equity investments is recognized on the income statement. Unrealized gains/losses on debt investments classified as available for sales is recognized as other comprehensive income. (Hint: Unrealized Gains and Losses - OCI are closed to Accumulated Other Comprehensive Income at the end of the year.) 1. On March 1, 2023 DeeDee purchased the copyrights of some accounting games for $120,000. They believe the useful life will be five years. The company's amortization policy is that amortization should be calculated based 2 adjusting entry, the column amount will automatically change. All adjustments should be labeled ar and be in the order of the information provided

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts