Question: Please take your time to answer this question based off the information I provided you in the screen shot. Please take your time and complete

Please take your time to answer this question based off the information I provided you in the screen shot. Please take your time and complete this question to the best of your ability for a thumbs up. Thank you!

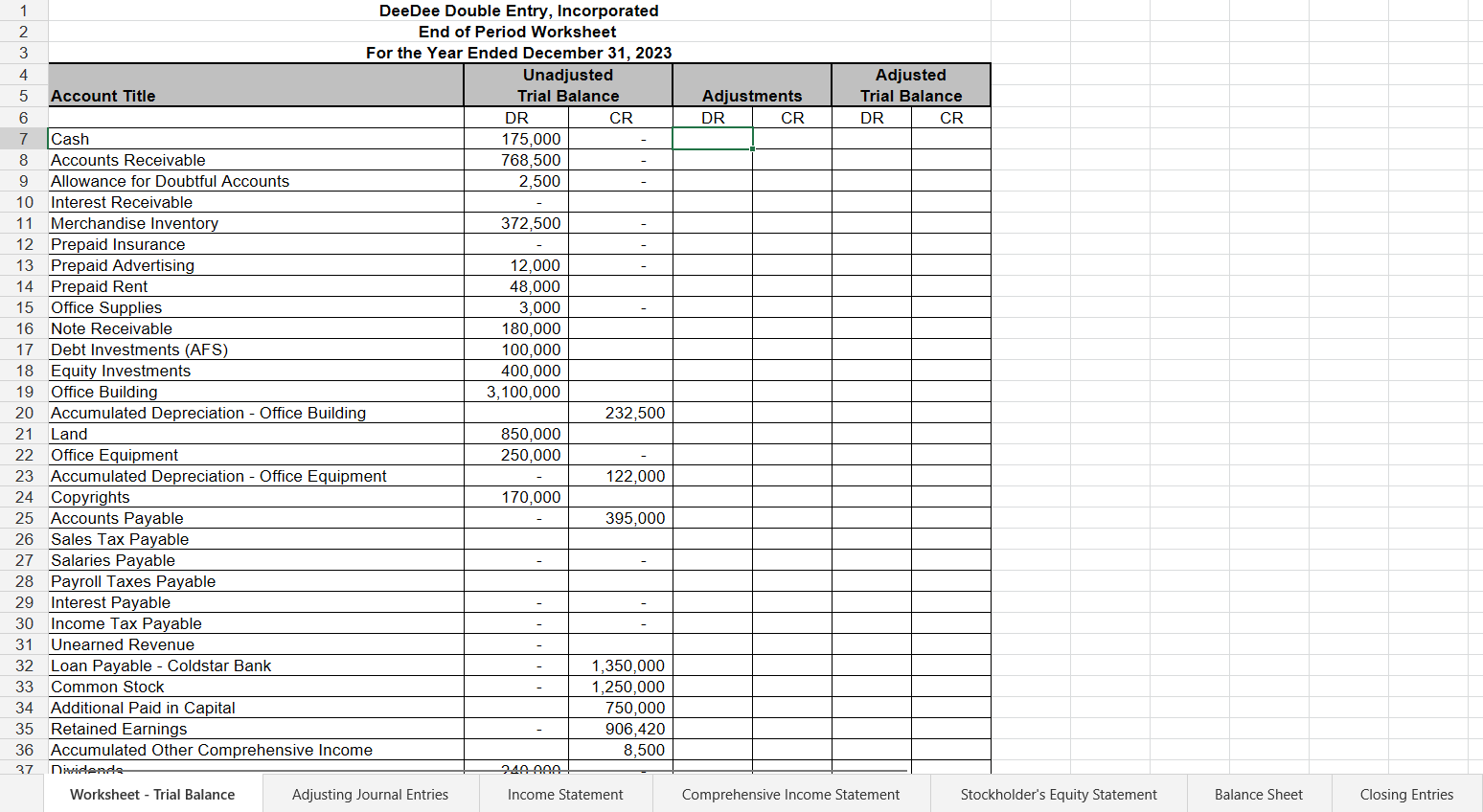

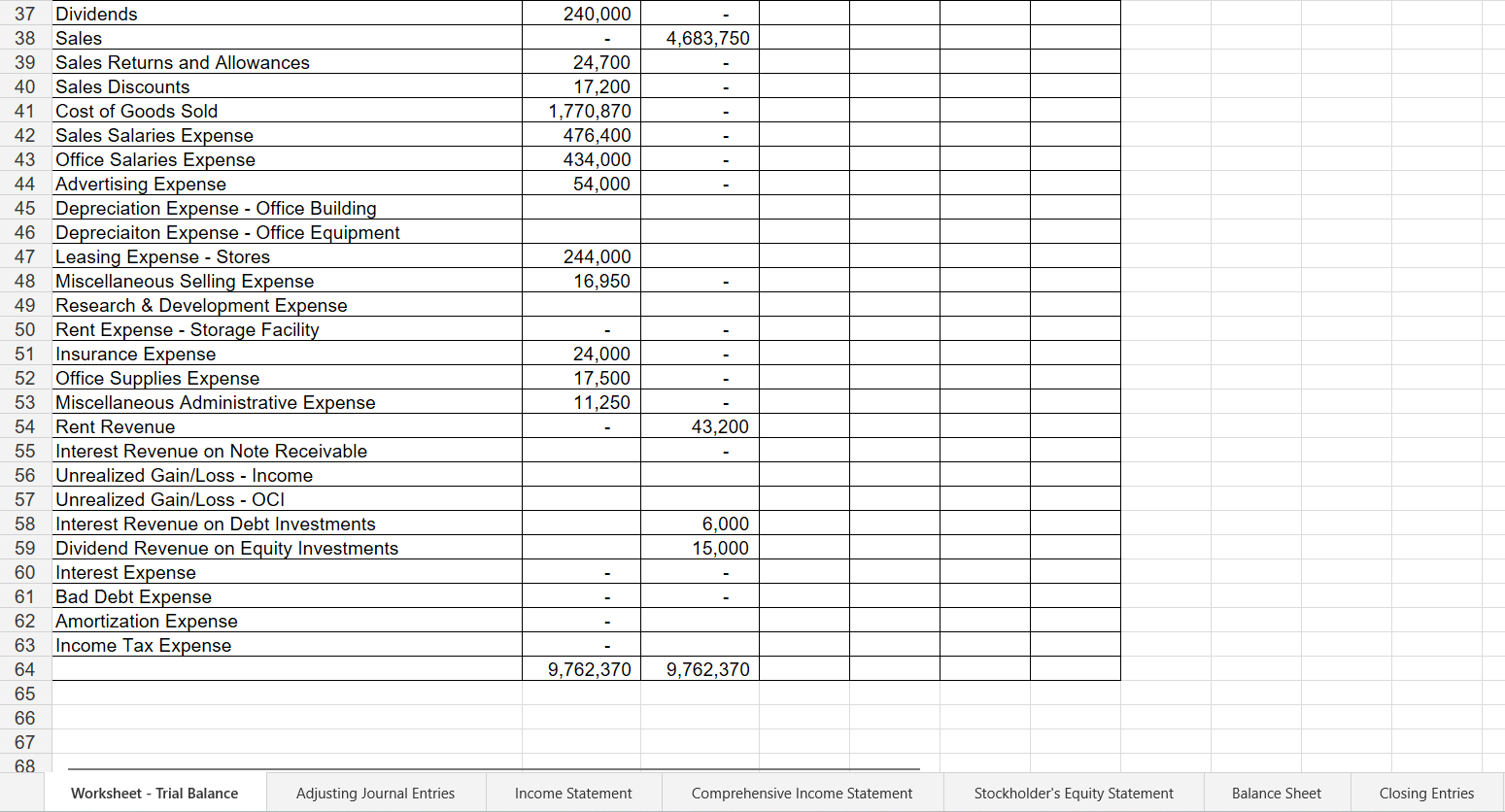

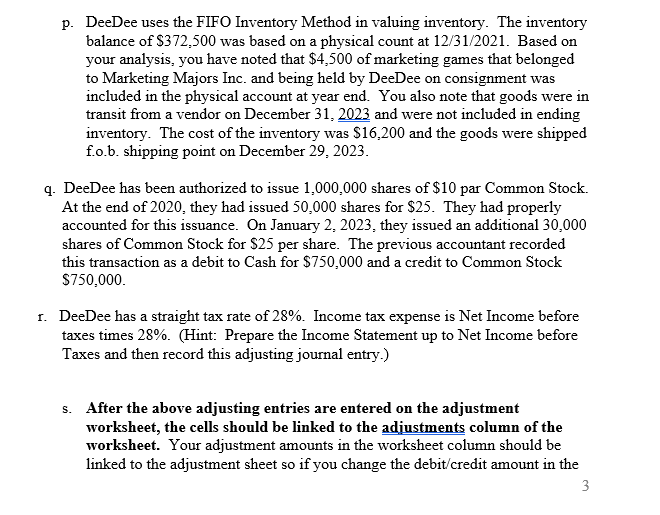

65 66 67 68 Worksheet - Trial Balance Adjusting Journal Entries Income Statement Comprehensive Income Statement Stockholder's Equity Statement Balance Sheet Closing Entries p. DeeDee uses the FIFO Inventory Method in valuing inventory. The inventory balance of $372,500 was based on a physical count at 12/31/2021. Based on your analysis, you have noted that $4,500 of marketing games that belonged to Marketing Majors Inc. and being held by DeeDee on consignment was included in the physical account at year end. You also note that goods were in transit from a vendor on December 31,2023 and were not included in ending inventory. The cost of the inventory was $16,200 and the goods were shipped f.o.b. shipping point on December 29, 2023. q. DeeDee has been authorized to issue 1,000,000 shares of $10 par Common Stock. At the end of 2020 , they had issued 50,000 shares for $25. They had properly accounted for this issuance. On January 2, 2023, they issued an additional 30,000 shares of Common Stock for $25 per share. The previous accountant recorded this transaction as a debit to Cash for $750,000 and a credit to Common Stock $750,000 r. DeeDee has a straight tax rate of 28%. Income tax expense is Net Income before taxes times 28%. (Hint: Prepare the Income Statement up to Net Income before Taxes and then record this adjusting journal entry.) s. After the above adjusting entries are entered on the adjustment worksheet, the cells should be linked to the adjustments column of the worksheet. Your adjustment amounts in the worksheet column should be linked to the adjustment sheet so if you change the debit/credit amount in the 3 65 66 67 68 Worksheet - Trial Balance Adjusting Journal Entries Income Statement Comprehensive Income Statement Stockholder's Equity Statement Balance Sheet Closing Entries p. DeeDee uses the FIFO Inventory Method in valuing inventory. The inventory balance of $372,500 was based on a physical count at 12/31/2021. Based on your analysis, you have noted that $4,500 of marketing games that belonged to Marketing Majors Inc. and being held by DeeDee on consignment was included in the physical account at year end. You also note that goods were in transit from a vendor on December 31,2023 and were not included in ending inventory. The cost of the inventory was $16,200 and the goods were shipped f.o.b. shipping point on December 29, 2023. q. DeeDee has been authorized to issue 1,000,000 shares of $10 par Common Stock. At the end of 2020 , they had issued 50,000 shares for $25. They had properly accounted for this issuance. On January 2, 2023, they issued an additional 30,000 shares of Common Stock for $25 per share. The previous accountant recorded this transaction as a debit to Cash for $750,000 and a credit to Common Stock $750,000 r. DeeDee has a straight tax rate of 28%. Income tax expense is Net Income before taxes times 28%. (Hint: Prepare the Income Statement up to Net Income before Taxes and then record this adjusting journal entry.) s. After the above adjusting entries are entered on the adjustment worksheet, the cells should be linked to the adjustments column of the worksheet. Your adjustment amounts in the worksheet column should be linked to the adjustment sheet so if you change the debit/credit amount in the 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts