Question: please type the answer by computer, so I can see it clearly, thank you!!! (v) Calculate the additional common stock required so that common equity

please type the answer by computer, so I can see it clearly, thank you!!!

(v) Calculate the additional common stock required so that common equity Tier I risk-based capital ratio

can attain the Well-capitalized level.

(vi) Calculate the volatile commercial RE loan to be added by selling T-bills so that Total risk-based

capital ratio can still attain the Adequately-capitalized level.

(vii) What is the required reserve ratio?

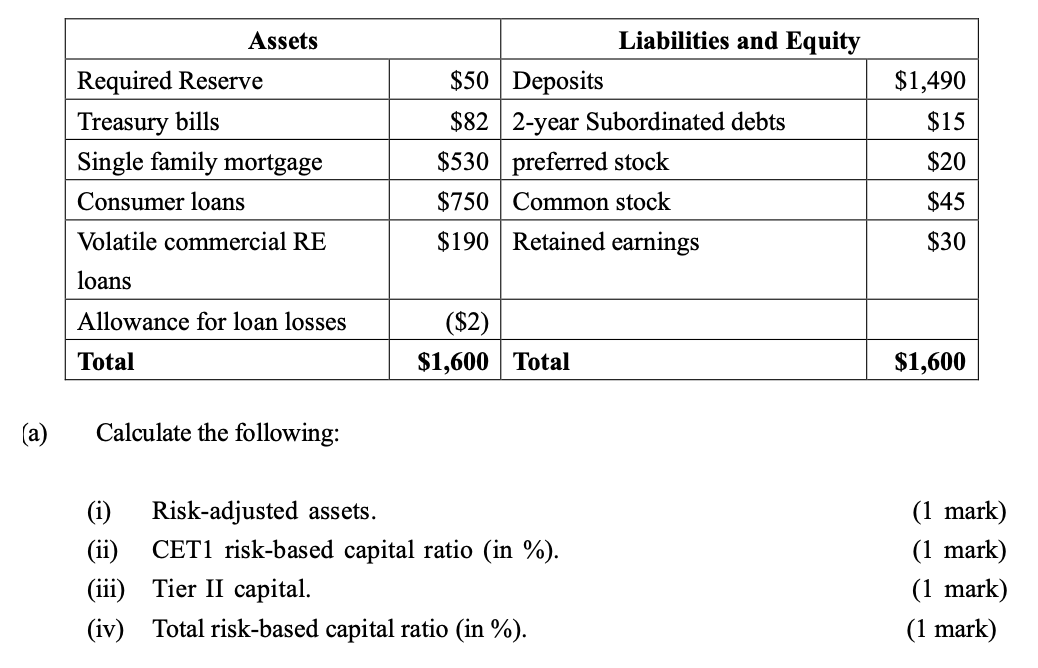

Assets Required Reserve Treasury bills Single family mortgage Consumer loans Volatile commercial RE loans Liabilities and Equity $50 Deposits $82 2-year Subordinated debts $530 preferred stock $750 Common stock $190 Retained earnings $1,490 $15 $20 $45 $30 ($2) Allowance for loan losses Total $1,600 Total $1,600 (a) Calculate the following: (i) Risk-adjusted assets. (ii) CET1 risk-based capital ratio (in %). (iii) Tier II capital. (iv) Total risk-based capital ratio (in %). (1 mark) (1 mark) (1 mark) (1 mark) Assets Required Reserve Treasury bills Single family mortgage Consumer loans Volatile commercial RE loans Liabilities and Equity $50 Deposits $82 2-year Subordinated debts $530 preferred stock $750 Common stock $190 Retained earnings $1,490 $15 $20 $45 $30 ($2) Allowance for loan losses Total $1,600 Total $1,600 (a) Calculate the following: (i) Risk-adjusted assets. (ii) CET1 risk-based capital ratio (in %). (iii) Tier II capital. (iv) Total risk-based capital ratio (in %). (1 mark) (1 mark) (1 mark) (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts