Question: please type the answer for these questions by computer dont write it by hand 1:10-32 Sec. 179 Expensing Election and MACRS Depreciation. In 2018, Richmond

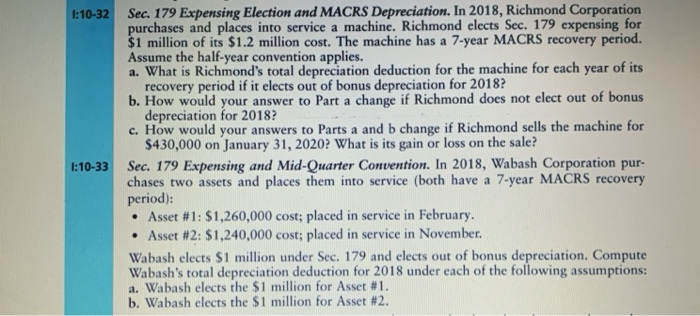

1:10-32 Sec. 179 Expensing Election and MACRS Depreciation. In 2018, Richmond Corporation purchases and places into service a machine. Richmond elects Sec. 179 expensing for $1 million of its $1.2 million cost. The machine has a 7-year MACRS recovery period. Assume the half-year convention applies. a. What is Richmond's total depreciation deduction for the machine for each year of its recovery period if it elects out of bonus depreciation for 2018? b. How would your answer to Part a change if Richmond does not elect out of bonus depreciation for 2018? c. How would your answers to Parts a and b change if Richmond sells the machine for $430,000 on January 31, 2020? What is its gain or loss on the sale? 1:10-33 Sec. 179 Expensing and Mid-Quarter Convention. In 2018, Wabash Corporation pur- chases two assets and places them into service (both have a 7-year MACRS recovery period): Asset #1: $1,260,000 cost; placed in service in February. Asset #2: $1,240,000 cost; placed in service in November. Wabash elects $1 million under Sec. 179 and elects out of bonus depreciation. Compute Wabash's total depreciation deduction for 2018 under each of the following assumptions: a. Wabash elects the $1 million for Asset #1. b. Wabash elects the $1 million for Asset #2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts