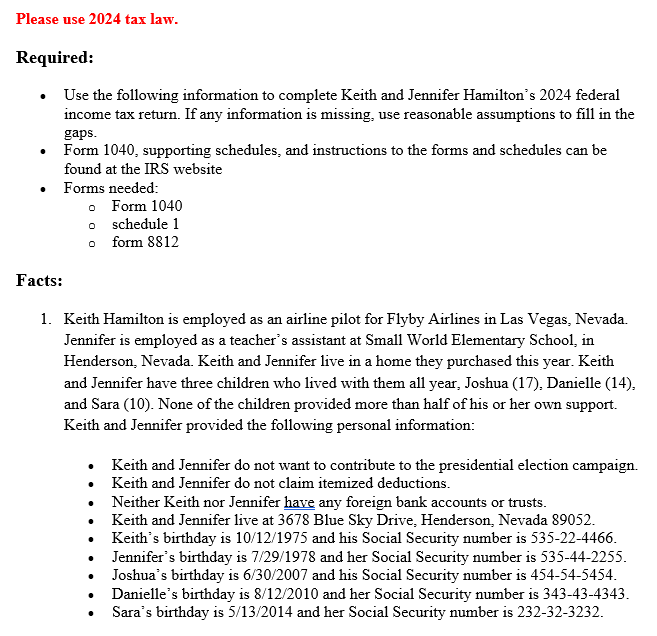

Question: Please use 2 0 2 4 tax law. Required: Use the following information to complete Keith and Jennifer Hamilton's 2 0 2 4 federal income

Please use tax law.

Required:

Use the following information to complete Keith and Jennifer Hamilton's federal

income tax return. If any information is missing, use reasonable assumptions to fill in the

gaps.

Form supporting schedules, and instructions to the forms and schedules can be

found at the IRS website

Forms needed:

Form

schedule

form

Facts:

Keith Hamilton is employed as an airline pilot for Flyby Airlines in Las Vegas, Nevada.

Jennifer is employed as a teacher's assistant at Small World Elementary School, in

Henderson, Nevada. Keith and Jennifer live in a home they purchased this year. Keith

and Jennifer have three children who lived with them all year, Joshua Danielle

and Sara None of the children provided more than half of his or her own support.

Keith and Jennifer provided the following personal information:

Keith and Jennifer do not want to contribute to the presidential election campaign.

Keith and Jennifer do not claim itemized deductions.

Neither Keith nor Jennifer have any foreign bank accounts or trusts.

Keith and Jennifer live at Blue Sky Drive, Henderson, Nevada

Keith's birthday is and his Social Security number is

Jennifer's birthday is and her Social Security number is

Joshua's birthday is and his Social Security number is

Danielle's birthday is and her Social Security number is

Sara's birthday is and her Social Security number is

Keith received the following Form W for from Flyby Airlines.

Jennifer received the following Form W Hit from Small World Elementary School.

During Keith and Jennifer received $ in interest from Las Vegas municipal bonds, $ interest from US Treasury bonds, and $ from their savings account at SCD Credit Union. Keith and Jennifer are joint owners of the Las Vegas city bonds and the US Treasury bonds. They have a joint savings account at SCD Credit Union.

On January Jennifer was involved in a car accident. Because the other driver was at fault, the other driver's insurance company paid Jennifer $ for medical expenses relating to her injuries from the accident and $ for emotional distress from the accident. She received payment on March

Keith's father died on November Keith received a $ death benefit from his father's life insurance policy on February

On February Keith hurt his arm on a family skiing trip in Utah and was unable to fly for two weeks. He received $ for disability pay from his disability insurance policy. He received the check on March Flyby Airlines paid $ in premiums on this policy during The disability insurance policy premiums are paid for by Flyby Airlines as a fully taxable fringe benefit to Keith the premiums paid on his behalf are included in Keith's compensation amount on his W

Jennifer's grandmother died on March leaving Jennifer with an inheritance of $ She received the inheritance on May

Flyby Airlines had space available on its Long Island, New York, flight and provided Keith, Jennifer, and their three children with free flights so they could attend the funeral. The value of the ticket for each passenger was $

On April Jennifer slipped in the Small World Elementary lunchroom and injured her back. Jennifer received $ in worker's compensation benefits because her workrelated injury caused her to miss two weeks of work. She also received a $ reimbursement for medical expenses from the health insurance company. Small World Elementary pays the premiums for Jennifer's health insurance policy as a nontaxable fringe benefit.

On May Keith and Jennifer received a federal income tax refund of $ from their federal income tax return.

On June Keith and Jennifer sold their home in Henderson, Nevada, for $ net of commissions Keith and Jennifer purchased the home years ago for $ On July they bought a new home for $

On July Keith's aunt Beatrice gave Keith $ because she wanted to let everyone know that Keith is her favorite nephew.

On September Jennifer won an iPad valued at $ in a raffle at the annual fair held at Joshua's high school.

Keith and Jennifer did not buy, sell, exchange, or otherwise acquire any financial interest in a virtual currency.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock