Question: Please use data below to answer the next four questions. Option contract is for Canadian Dollars (CD); Each contract is for CD 50,000. All quotes

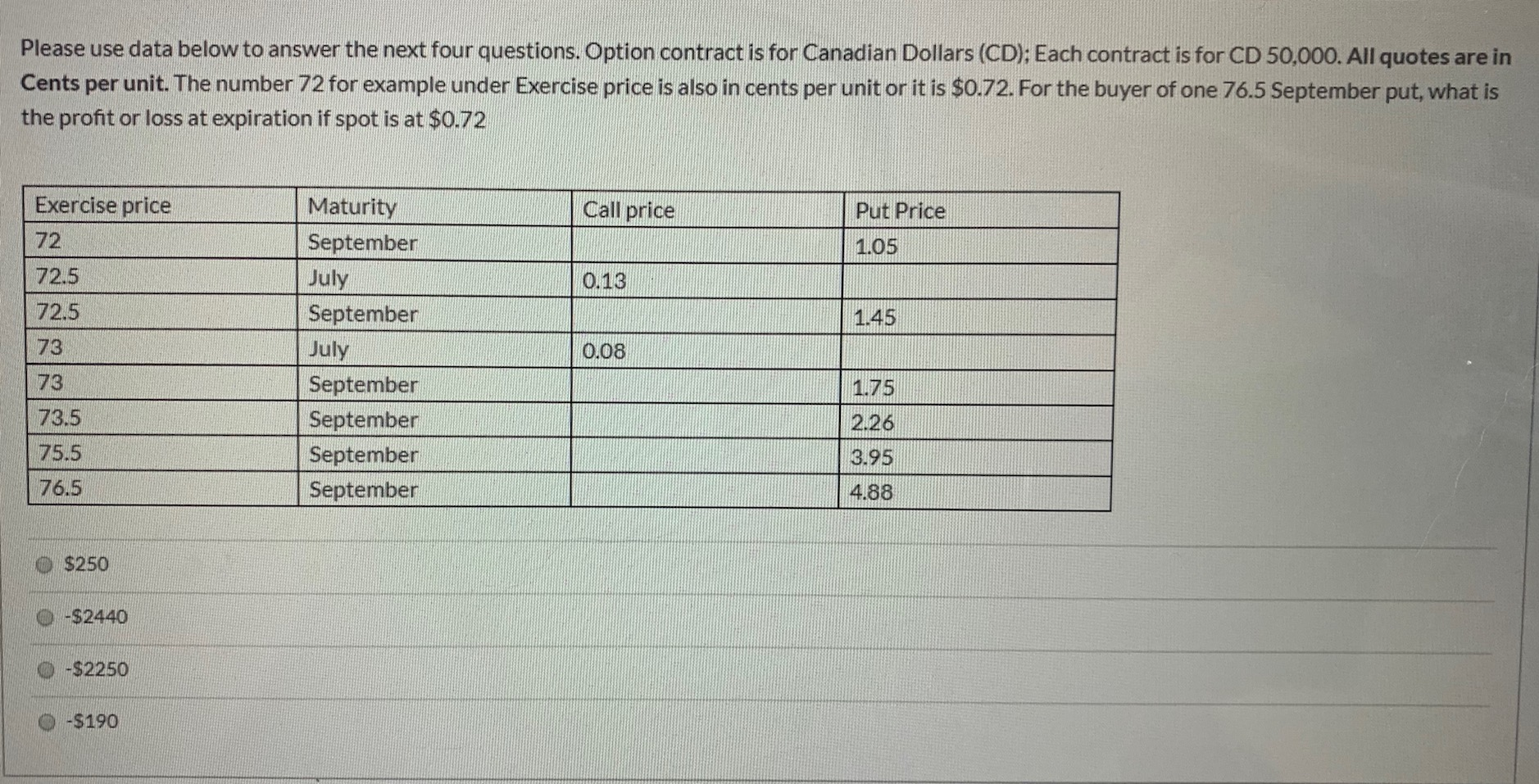

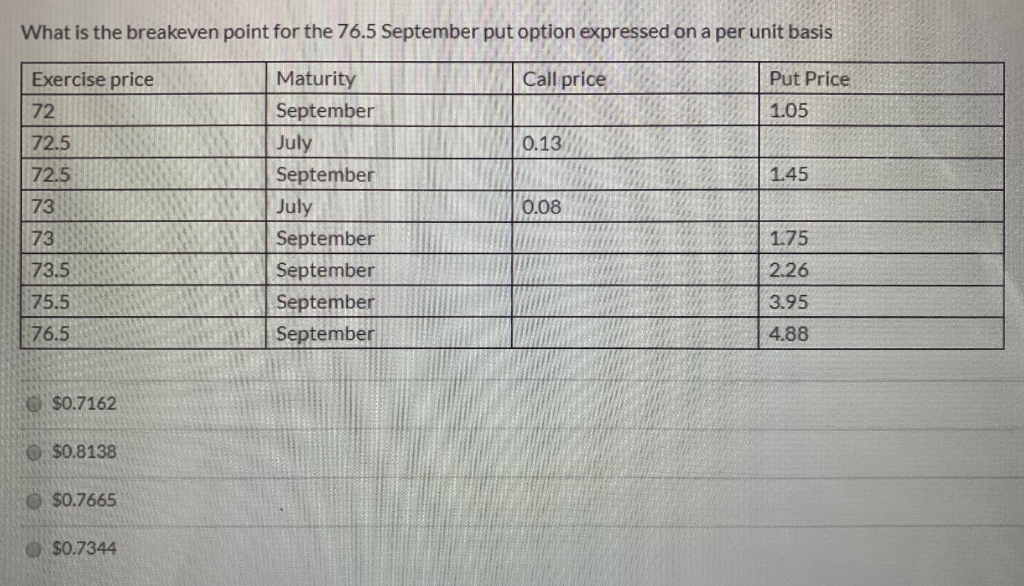

Please use data below to answer the next four questions. Option contract is for Canadian Dollars (CD); Each contract is for CD 50,000. All quotes are in Cents per unit. The number 72 for example under Exercise price is also in cents per unit or it is $0.72. For the buyer of one 76.5 September put, what is the profit or loss at expiration if spot is at $0.72 Exercise price Call price Put Price 1.05 72 72.5 72.5 0.13 1.45 73 Maturity September July September July September September September September 0.08 78 1.75 2.26 73.5 75.5 3.95 76.5 4.88 o $250 O -2440 0 -82250 0 -$190 What is the breakeven point for the 76.5 September put option expressed on a per unit basis Call price Put Price 1.05 Exercise price 72 72.5 72.5 73 0.13 1.45 Maturity September July September July September September September September 0.08 73 73.5 1.75 2.26 3.95 4.88 75.5 76.5 $0.7162 $0.8138 $0.7665 $0.7344

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts