Question: Please use excel and show me the formulas used. I have attached example templates from the textbook mentioned in the question. Magneto came up with

Please use excel and show me the formulas used. I have attached example templates from the textbook mentioned in the question.

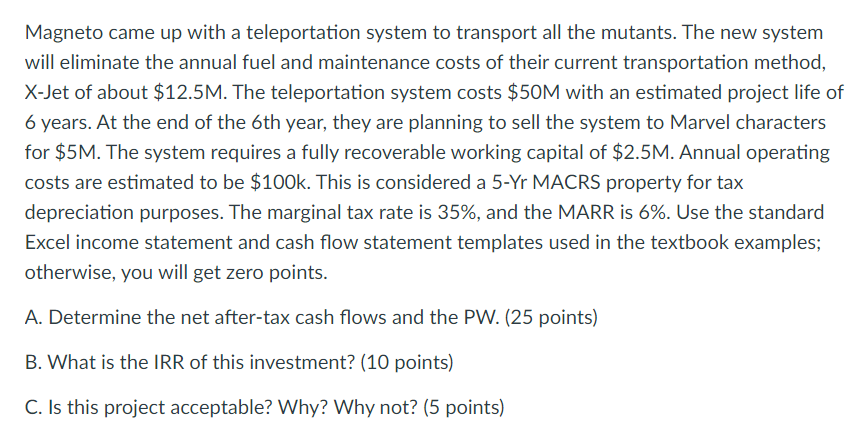

Magneto came up with a teleportation system to transport all the mutants. The new system will eliminate the annual fuel and maintenance costs of their current transportation method, XJet of about $M The teleportation system costs $M with an estimated project life of years. At the end of the th year, they are planning to sell the system to Marvel characters for $M The system requires a fully recoverable working capital of $M Annual operating costs are estimated to be $k This is considered a Yr MACRS property for tax depreciation purposes. The marginal tax rate is and the MARR is Use the standard Excel income statement and cash flow statement templates used in the textbook examples; otherwise, you will get zero points. A Determine the net aftertax cash flows and the PW points B What is the IRR of this investment? points C Is this project acceptable? Why? Why not? points Magneto came up with a teleportation system to transport all the mutants. The new system will eliminate the annual fuel and maintenance costs of their current transportation method, XJet of about $ mathrmM The teleportation system costs $ mathrmM with an estimated project life of years. At the end of the th year, they are planning to sell the system to Marvel characters for $ mathrmM The system requires a fully recoverable working capital of $ mathrmM Annual operating costs are estimated to be $ mathrmk This is considered a mathrmYr MACRS property for tax depreciation purposes. The marginal tax rate is and the MARR is Use the standard Excel income statement and cash flow statement templates used in the textbook examples; otherwise, you will get zero points.

A Determine the net aftertax cash flows and the PW points

B What is the IRR of this investment? points

C Is this project acceptable? Why? Why not? pointsbegintabularcccccc

hline multicolumnlIncome Statement

hline End of Year & & & & &

hline Revenue & & $ & $ & $ & $

hline multicolumnlExpenses:

hline O&M & & & & &

hline Depreciation & & & & &

hline Taxable income & & & & &

hline Income taxes & & & & &

hline Net income & & $ & $ & $ & $

hline multicolumnlCash Flow Statement

hline multicolumnlOperating Activities:

hline Net income & & & & &

hline Depreciation & & & & &

hline multicolumnlInvesting Activities:

hline Machine tools & $ & & multicolumnlNPVC:FB

hline Working capital & & & & &

hline Salvage value & multicolumnlNPVC:FB & &

hline Gains tax & & & & &

hline Net Cash Flow in Actual $ & $ & $ & $ & $ & $

hline Net Cash Flow in Constant $ & $ & $ & $ & $ & $

hline & & $ & & & $

hline & PW & $ & & W & $

hline & IRR & & & IRR' &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock