Question: please use excel functions Following is information about bonds that are identical except for their terms to maturity: Bond Coupon Maturity Price Yield (YTM FNO

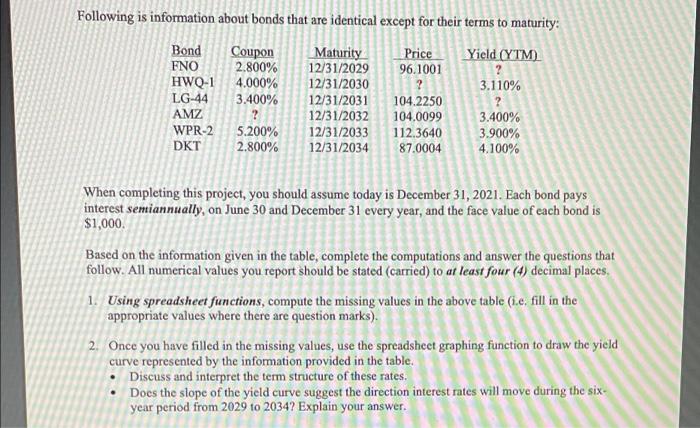

Following is information about bonds that are identical except for their terms to maturity: Bond Coupon Maturity Price Yield (YTM FNO 2.800% 12/31/2029 96.1001 ? HWQ-1 4.000% 12/31/2030 3.110% LG-44 3.400% 12/31/2031 104.2250 AMZ 12/31/2032 104.0099 3.400% WPR-2 5.200% 12/31/2033 112.3640 3.900% DKT 2.800% 12/31/2034 87.0004 4.100% ? When completing this project, you should assume today is December 31, 2021. Each bond pays interest sentiannually, on June 30 and December 31 every year, and the face value of each bond is $1,000 Based on the information given in the table, complete the computations and answer the questions that follow. All numerical values you report should be stated (carried) to at least four (4) decimal places, 1. Using spreadsheet functions, compute the missing values in the above table (.c. fill in the appropriate values where there are question marks). 2. Once you have filled in the missing values, use the spreadsheet graphing function to draw the yield curve represented by the information provided in the table. Discuss and interpret the term structure of these rates, Does the slope of the yield curve suggest the direction interest rates will move during the six- year period from 2029 to 2034? Explain your answer. s yourer

Step by Step Solution

There are 3 Steps involved in it

To calculate the missing Yields to Maturity YTM for the bonds FNO and LG44 using Excel functions fol... View full answer

Get step-by-step solutions from verified subject matter experts