1. The separate incomes of Pil Corporation and Sil Corporation, a 100 percent-owned subsidiary of Pil, for...

Question:

1. The separate incomes of Pil Corporation and Sil Corporation, a 100 percent-owned subsidiary of Pil, for 2012 are $2,000,000 and $1,000,000, respectively. Pil sells all of its output to Sil at 150 percent of Pil's cost of production.

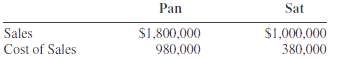

During 2011 and 2012, Pil's sales to Sil were $9,000,000 and $7,000,000, respectively. Sil's inventory at December 31, 2011, included $3,000,000 of the merchandise acquired from Pil, and its December 31, 2012, inventory included $2,400,000 of such merchandise. Assume Sil sells the inventory purchased from Pil in the following year. A consolidated income statement for Pil Corporation and Subsidiary for 2012 should show controlling interest share of consolidated net income of:a. $2,200,000b. $2,800,000c. $3,000,000d. $3,200,000Pan Corporation owns 75 percent of the voting common stock of Sat Corporation, acquired at book value during 2011. Selected information from the accounts of Pan and Sat for 2011 are as follows: During 2012 Pan sold merchandise to Sat for $100,000, at a gross profit to Pan of $40,000. Half of this merchandise remained in Sat's inventory at December 31, 2012. Sat's December 31, 2011, inventory included unrealized profit of $8,000 on goods acquired from Pan.2. In a consolidated income statement for Pan Corporation and Subsidiary for the year 2012, consolidated sales should be:a. $2,900,000b. $2,800,000c. $2,725,000d. $2,700,0003. In a consolidated income statement for Pan Corporation and Subsidiary for the year 2012, consolidated cost of sales should be:a. $1,372,000b. $1,360,000c. $1,272,000d.$1,248,000

Common StockCommon stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Consolidated Income Statement

When talking about the group financial statements the consolidated financial statements include Consolidated Income Statement that a parent must prepare among other sets of consolidated financial statements. Consolidated Income statement that is... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith