Question: Please use excel to solve and show the formulas used. 4 Consider the following cash flow for an investment: Year 0 1 2 3 5

Please use excel to solve and show the formulas used.

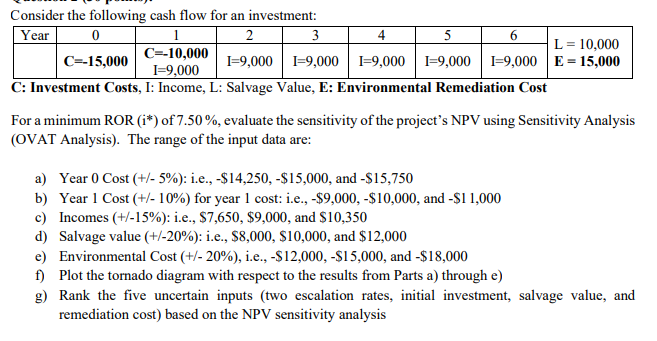

4 Consider the following cash flow for an investment: Year 0 1 2 3 5 6 L = 10,000 C=-15,000 C=-10,000 I=9,000 I=9,000 1=9,000 1=9,000 1=9,000 1=9,000 E = 15,000 C: Investment Costs, I: Income, L: Salvage Value, E: Environmental Remediation Cost For a minimum ROR (i*) of 7.50%, evaluate the sensitivity of the project's NPV using Sensitivity Analysis (OVAT Analysis). The range of the input data are: a) Year 0 Cost (+/- 5%): i.e., -$14,250,-$15,000, and -$15,750 b) Year 1 Cost (+/- 10%) for year 1 cost: i.e., -$9,000,-$10,000, and -$11,000 c) Incomes (+/-15%): i.e., $7,650, $9,000, and $10,350 d) Salvage value (+/-20%): i.e., $8,000, $10,000, and $12,000 e) Environmental Cost (+/- 20%), i.e., -$12,000,-$15,000, and -$18,000 f) Plot the tornado diagram with respect to the results from Parts a) through e) g) Rank the five uncertain inputs (two escalation rates, initial investment, salvage value, and remediation cost) based on the NPV sensitivity analysis 4 Consider the following cash flow for an investment: Year 0 1 2 3 5 6 L = 10,000 C=-15,000 C=-10,000 I=9,000 I=9,000 1=9,000 1=9,000 1=9,000 1=9,000 E = 15,000 C: Investment Costs, I: Income, L: Salvage Value, E: Environmental Remediation Cost For a minimum ROR (i*) of 7.50%, evaluate the sensitivity of the project's NPV using Sensitivity Analysis (OVAT Analysis). The range of the input data are: a) Year 0 Cost (+/- 5%): i.e., -$14,250,-$15,000, and -$15,750 b) Year 1 Cost (+/- 10%) for year 1 cost: i.e., -$9,000,-$10,000, and -$11,000 c) Incomes (+/-15%): i.e., $7,650, $9,000, and $10,350 d) Salvage value (+/-20%): i.e., $8,000, $10,000, and $12,000 e) Environmental Cost (+/- 20%), i.e., -$12,000,-$15,000, and -$18,000 f) Plot the tornado diagram with respect to the results from Parts a) through e) g) Rank the five uncertain inputs (two escalation rates, initial investment, salvage value, and remediation cost) based on the NPV sensitivity analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts