Question: Please use Excel to solve this question with steps. Thanks. 11. 10 points - Stocks - Value Per Share You have an assignment to estimate

Please use Excel to solve this question with steps. Thanks.

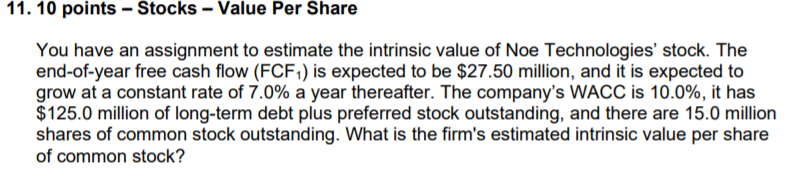

11. 10 points - Stocks - Value Per Share You have an assignment to estimate the intrinsic value of Noe Technologies' stock. The end-of-year free cash flow (FCF1) is expected to be $27.50 million, and it is expected to grow at a constant rate of 7.0% a year thereafter. The company's WACC is 10.0%, it has $125.0 million of long-term debt plus preferred stock outstanding, and there are 15.0 million shares of common stock outstanding. What is the firm's estimated intrinsic value per share of common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts