Question: . Please use linear programming to solve the maximum NPV value and the solution for each project: Restating the problem in linear programming equations, the

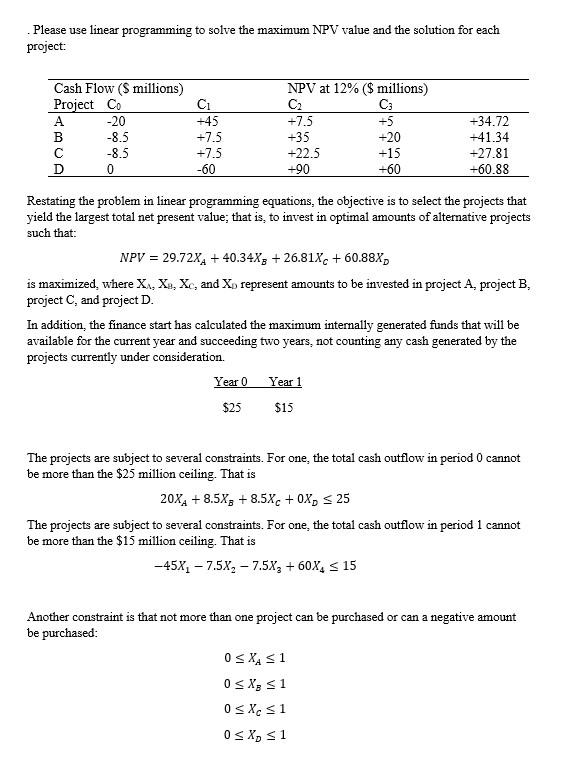

. Please use linear programming to solve the maximum NPV value and the solution for each project: Restating the problem in linear programming equations, the objective is to select the projects that yield the largest total net present value; that is, to invest in optimal amounts of alternative projects such that: NPV=29.72XA+40.34XB+26.81XC+60.88XD is maximized, where XN,XB,XC, and XD represent amounts to be invested in project A, project B, project C, and project D. In addition, the finance start has calculated the maximum internally generated funds that will be available for the current year and succeeding two years, not counting any cash generated by the projects currently under consideration. The projects are subject to several constraints. For one, the total cash outflow in period 0 cannot be more than the $25 million ceiling. That is 20XA+8.5XB+8.5XC+0XD25 The projects are subject to several constraints. For one, the total cash outflow in period 1 cannot be more than the $15 million ceiling. That is 45X17.5X27.5X3+60X415 Another constraint is that not more than one project can be purchased or can a negative amount be purchased: 0XA10XB10XC10XD1 . Please use linear programming to solve the maximum NPV value and the solution for each project: Restating the problem in linear programming equations, the objective is to select the projects that yield the largest total net present value; that is, to invest in optimal amounts of alternative projects such that: NPV=29.72XA+40.34XB+26.81XC+60.88XD is maximized, where XN,XB,XC, and XD represent amounts to be invested in project A, project B, project C, and project D. In addition, the finance start has calculated the maximum internally generated funds that will be available for the current year and succeeding two years, not counting any cash generated by the projects currently under consideration. The projects are subject to several constraints. For one, the total cash outflow in period 0 cannot be more than the $25 million ceiling. That is 20XA+8.5XB+8.5XC+0XD25 The projects are subject to several constraints. For one, the total cash outflow in period 1 cannot be more than the $15 million ceiling. That is 45X17.5X27.5X3+60X415 Another constraint is that not more than one project can be purchased or can a negative amount be purchased: 0XA10XB10XC10XD1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts