Question: PLEASE USE MATLAB For an account that accrues compounded interest, the formula for balance after one interest period is: Balance new=( Balance old+ Deposits Withdrawals

PLEASE USE MATLAB

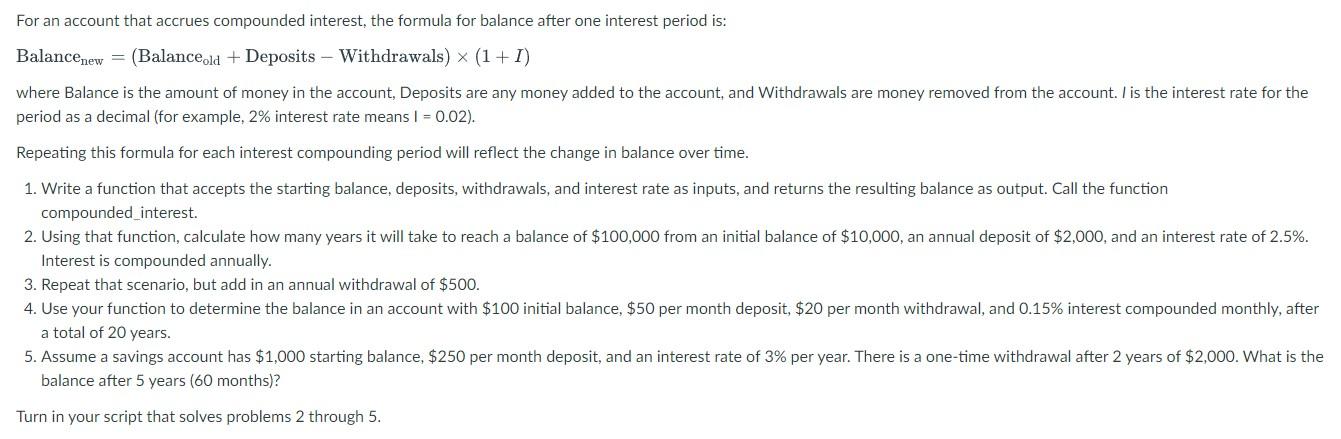

For an account that accrues compounded interest, the formula for balance after one interest period is: Balance new=( Balance old+ Deposits Withdrawals )(1+I) where Balance is the amount of money in the account, Deposits are any money added to the account, and Withdrawals are money removed from the account. I is the interest rate for the period as a decimal (for example, 2% interest rate means I=0.02 ). Repeating this formula for each interest compounding period will reflect the change in balance over time. 1. Write a function that accepts the starting balance, deposits, withdrawals, and interest rate as inputs, and returns the resulting balance as output. Call the function compounded_interest. 2. Using that function, calculate how many years it will take to reach a balance of $100,000 from an initial balance of $10,000, an annual deposit of $2,000, and an interest rate of 2.5%. Interest is compounded annually. 3. Repeat that scenario, but add in an annual withdrawal of $500. 4. Use your function to determine the balance in an account with $100 initial balance, $50 per month deposit, $20 per month withdrawal, and 0.15% interest compounded monthly, after a total of 20 years. 5. Assume a savings account has $1,000 starting balance, $250 per month deposit, and an interest rate of 3% per year. There is a one-time withdrawal after 2 years of $2,000. What is balance after 5 years ( 60 months)? Turn in your script that solves problems 2 through 5. For an account that accrues compounded interest, the formula for balance after one interest period is: Balance new=( Balance old+ Deposits Withdrawals )(1+I) where Balance is the amount of money in the account, Deposits are any money added to the account, and Withdrawals are money removed from the account. I is the interest rate for the period as a decimal (for example, 2% interest rate means I=0.02 ). Repeating this formula for each interest compounding period will reflect the change in balance over time. 1. Write a function that accepts the starting balance, deposits, withdrawals, and interest rate as inputs, and returns the resulting balance as output. Call the function compounded_interest. 2. Using that function, calculate how many years it will take to reach a balance of $100,000 from an initial balance of $10,000, an annual deposit of $2,000, and an interest rate of 2.5%. Interest is compounded annually. 3. Repeat that scenario, but add in an annual withdrawal of $500. 4. Use your function to determine the balance in an account with $100 initial balance, $50 per month deposit, $20 per month withdrawal, and 0.15% interest compounded monthly, after a total of 20 years. 5. Assume a savings account has $1,000 starting balance, $250 per month deposit, and an interest rate of 3% per year. There is a one-time withdrawal after 2 years of $2,000. What is balance after 5 years ( 60 months)? Turn in your script that solves problems 2 through 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts