Question: Please use the Libor Discounting Method to answer this question... 1. Interest Rate Swap In an interest rate swap, a financial institution has agreed to

Please use the Libor Discounting Method to answer this question...

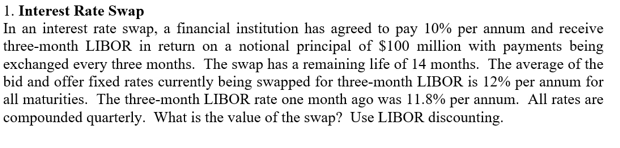

1. Interest Rate Swap In an interest rate swap, a financial institution has agreed to pay 10% per annum and receive three-month LIBOR in return on a notional principal of $100 million with payments being exchanged every three months. The swap has a remaining life of 14 months. The average of the bid and offer fixed rates currently being swapped for three-month LIBOR is 12% per annum for all maturities. The three-month LIBOR rate one month ago was 11.8% per annum. All rates are compounded quarterly. What is the value of the swap? Use LIBOR discounting

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts