Question: Please with full explained steps Question 6 1 pts Percival Hygiene has $10 million invested in long-term corporate bonds This bond portfolio's expected annual rate

Please with full explained steps

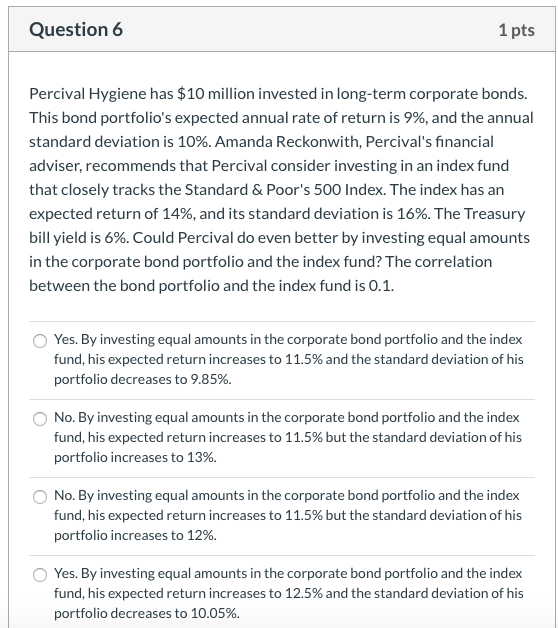

Question 6 1 pts Percival Hygiene has $10 million invested in long-term corporate bonds This bond portfolio's expected annual rate of return is 9%, and the annual standard deviation is 10%. Amanda Reckonwith, Percival's financial adviser, recommends that Percival consider investing in an index fund that closely tracks the Standard & Poor's 500 Index. The index has an expected return of 14%, and its standard deviation is 16%. The Treasury bill yield is 6%. Could Percival do even better by investing equal amounts in the corporate bond portfolio and the index fund? The correlation between the bond portfolio and the index fund is 0.1. Yes. By investing equal amounts in the corporate bond portfolio and the index fund, his expected return increases to 11.5% and the standard deviation of his portfolio decreases to 9.85% No. By investing equal amounts in the corporate bond portfolio and the index fund, his expected return increases to 11.5% but the standard deviation of his portfolio increases to 13% No. By investing equal amounts in the corporate bond portfolio and the index fund, his expected return increases to 11.5% but the standard deviation of his portfolio increases to 12% Yes. By investing equal amounts in the corporate bond portfolio and the index fund, his expected return increases to 12.5% and the standard deviation of his portfolio decreases to 10.05%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts