Question: please with the following financial math problem. l have attached the problem. Consider the three period ( N = 3 ) binomial model with So

please with the following financial math problem. l have attached the problem.

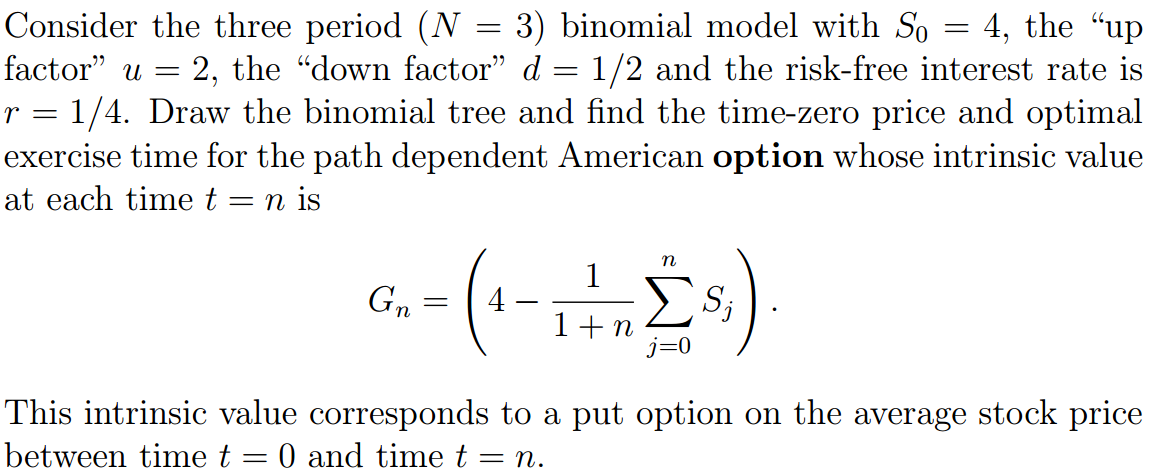

Consider the three period ( N = 3 ) binomial model with So = 4 , the " up factor " u = 2 , the " down factor" d = 1 / 2 and the risk- free interest rate is r = 1 / 4. Draw the binomial tree and find the time- zero price and optimal exercise time for the path dependent American option whose intrinsic value at each time t _ n is n Go. = | 4 - I t n IS ; j = 0 This intrinsic value corresponds to a put option on the average stock price between time t _ O and time t _ n

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts