Question: Please work out the problem step by step. He is a hard grader. He wants to see how we got the answer. I will really

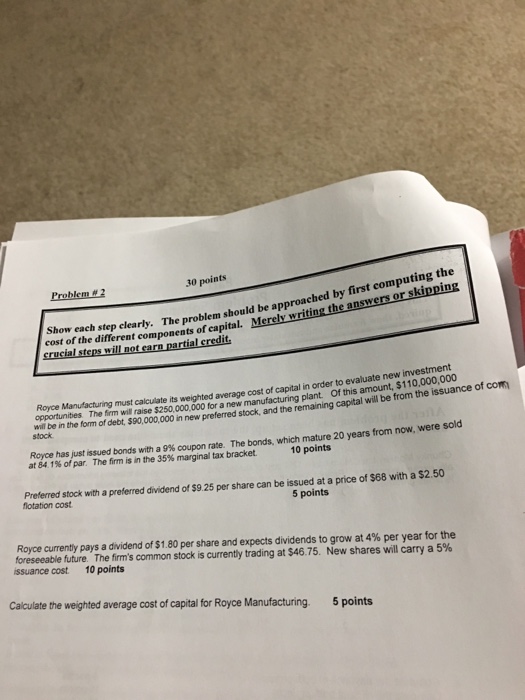

30 points cost of the different ca srucial steps will not carn partial credit of the dtifep clearly. The problem should be approached by first computing the components of capital. Merely writing the answers o Royce Manufacturing must calculate its weighted average cost of capital in order to evaluate new ve opportunites The firm will raise $250,000.000 for a new manufacturing plant Of this amount, $110,000,000 wi det,$90,000,000 n new preferred stock, and the remaining capital will be from the issua Royce ha just issued bonds with a 9% coupon rate. The bonds, which mature 20 years from now, were sold at 84 1% of par Thefim is n the 35% marginal tax bracket. 10 points Preferred stock with a preferred dividend of $9.25 per share can be issued at a price of $68 with a $2.50 flotation cost 5 points Royce currently pays a dividend of $1.80 per share and expects dividends to grow at 4% per year for the foreseeable future The firm's common stock is currently trading at S4675 New shares will carry a 5% issuance cost 10 points Calculate the weighted average cost of capital for Royce Manufacturing. 5 points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts