Question: please write down solution with detailed steps op Review: (a) The Sharpe Ratio (S) S= Portfolio Risk Premium Standard Deviation of Portfolio Excess Return (a)

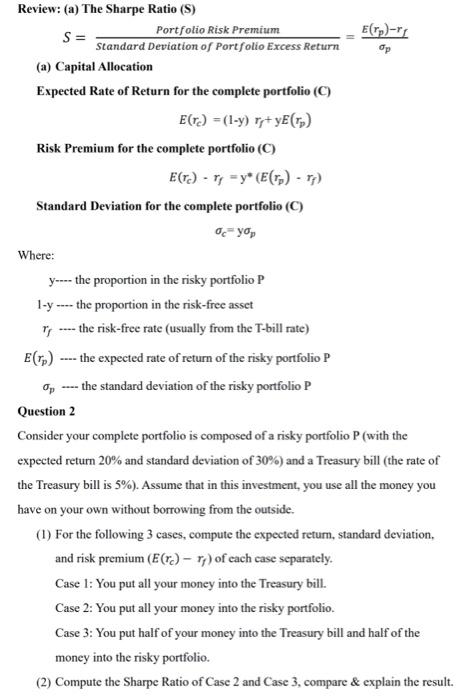

op Review: (a) The Sharpe Ratio (S) S= Portfolio Risk Premium Standard Deviation of Portfolio Excess Return (a) Capital Allocation Expected Rate of Return for the complete portfolio (C) E(r) = (1-y) ri+yE(T) Risk Premium for the complete portfolio (0) E(re) - r = y* (E() - ) Standard Deviation for the complete portfolio (C) Where: y---- the proportion in the risky portfolio P 1-y ---- the proportion in the risk-free asset T ---- the risk-free rate (usually from the T-bill rate) E() ---- the expected rate of return of the risky portfolio P op the standard deviation of the risky portfolio P Question 2 Consider your complete portfolio is composed of a risky portfolio P (with the expected return 20% and standard deviation of 30%) and a Treasury bill (the rate of the Treasury bill is 5%). Assume that in this investment, you use all the money you have on your own without borrowing from the outside. (1) For the following 3 cases, compute the expected return, standard deviation, and risk premium (E(r.) - ) of each case separately. Case 1: You put all your money into the Treasury bill. Case 2: You put all your money into the risky portfolio. Case 3: You put half of your money into the Treasury bill and half of the money into the risky portfolio. (2) Compute the Sharpe Ratio of Case 2 and Case 3, compare & explain the result

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts