Question: please write down solution with detailed steps Review: (a) Expected Rate of Return E() = p(s)r(s) (b) Variance Var(r) = 02 = P(S)[r(s) E())? (e)

please write down solution with detailed steps

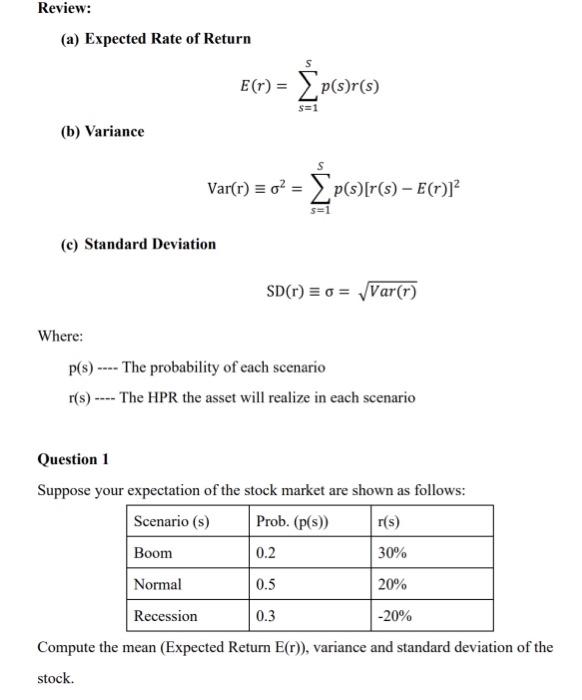

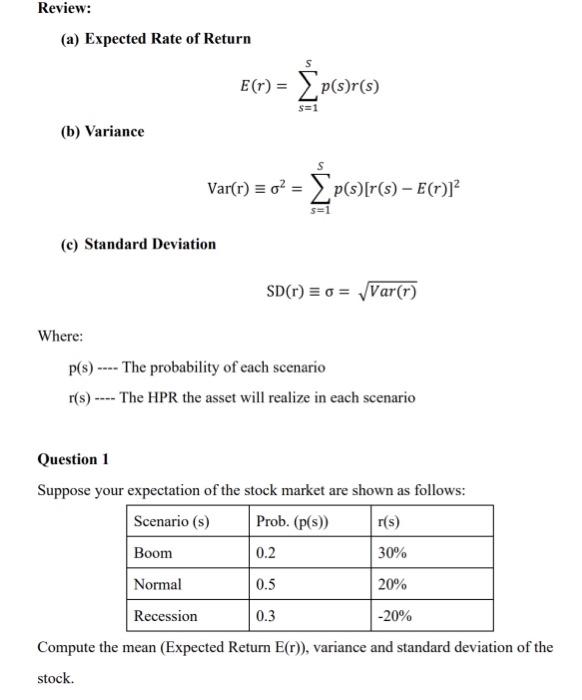

Review: (a) Expected Rate of Return E() = p(s)r(s) (b) Variance Var(r) = 02 = P(S)[r(s) E("))? (e) Standard Deviation SD(r) = 0 = Var(r) Where: p() ---- The probability of each scenario r(s) ---- The HPR the asset will realize in each scenario Question 1 Suppose your expectation of the stock market are shown as follows: Scenario (s) Prob. (p(s)) r(s) Boom 0.2 30% Normal 0.5 20% Recession 0.3 -20% Compute the mean (Expected Return E(r)), variance and standard deviation of the stock

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock