Question: please write the steps (no excel) Yield rates for zero-coupon bonds are as follows: 1-year maturity: 6% (effective annual); 2-year maturity: 6.9% (effective annual). A

please write the steps (no excel)

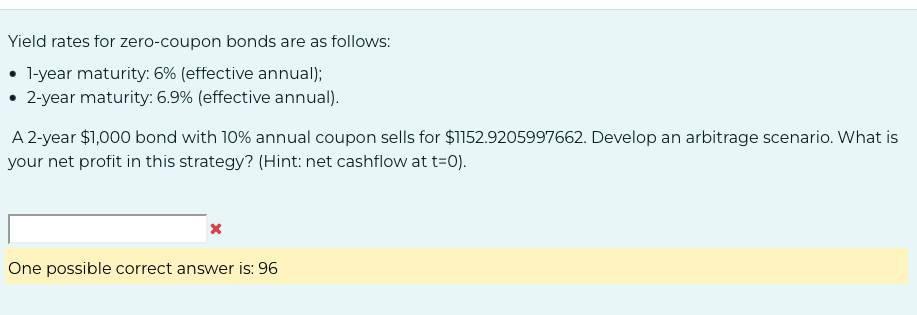

Yield rates for zero-coupon bonds are as follows: 1-year maturity: 6% (effective annual); 2-year maturity: 6.9% (effective annual). A 2-year $1,000 bond with 10% annual coupon sells for $1152.9205997662. Develop an arbitrage scenario. What is your net profit in this strategy? (Hint: net cashflow at t=0). x One possible correct answer is: 96

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts