Question: pls answer all questions or I'll thumbs down, for a), answer is $118517.71 , answer for b) is $189232 Bl Mary Fogarty earns $180,000 as

pls answer all questions or I'll thumbs down, for a), answer is $118517.71 , answer for b) is $189232

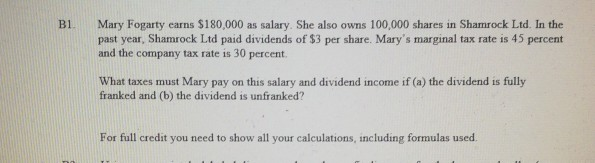

Bl Mary Fogarty earns $180,000 as salary. She also owns 100,000 shares in Shamrock Ltd. In the past year, Shamrock Ltd paid dividends of $3 per share. Mary's marginal tax rate is 45 percent and the company tax rate is 30 percent. What taxes must Mary pay on this salary and dividend income if (a) the dividend is fully franked and (b) the dividend is unfranked? For full credit you need to show all your calculations, including formulas used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts