Question: pls answer both Same tacts as the prior question, except Arry and Brian agree to pay $415,000 to purchase all of the BLI slock from

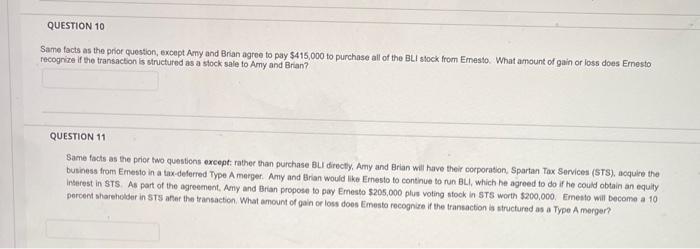

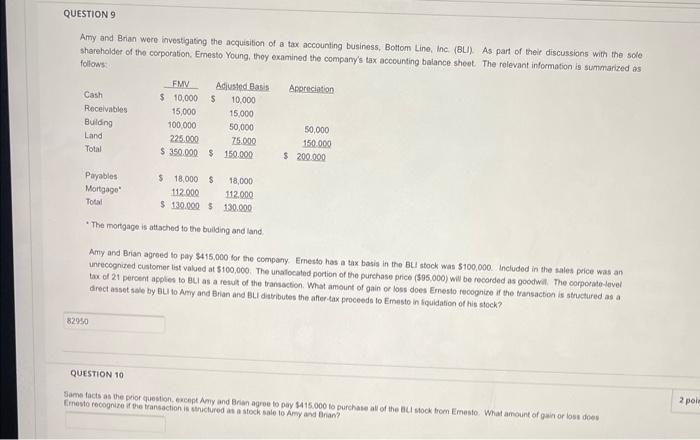

Same tacts as the prior question, except Arry and Brian agree to pay $415,000 to purchase all of the BLI slock from Emesto. What amount of gain or loss does Ermesto recogrize if the transaction is structured as a stock sale to Amy and Brian? QUESTION 11 Same facts as the prior two questions except: rather than purchase Bur directy, Amy and Brian will have their corporasion, Spartan Tax Sorvices (STS), acquice the business from Emesto in a tax-deferred Type A merger. Amy and Brian would like Emesto to continue to run BLl, which he agreed to do if he could obtain an equity Interest in SSS As part of the agreement, Any and Brian propose to pay Emesto $205,000 plus voting stock in \$15 worth $200,000. Emesto will Decomse a 10 percent sharehodber in sis anet the transaction. What amoum of gain or loss doos Emesto recognize if the transaction is structured as a Type A merger? Amy and Brian were investigating the acquisition of B tax accounting business, Bottom Line, inc. (BLI) As part of theic discussions with the sole shareholder of the corporation. Emesto Young, thoy examined the company's tax accounting balance sheet. The relevant information is summarized as follons: - The mortgage is attached to the builing and land: Amy and Brian agroed to pay $415,000 for the comparty. Emesto has a tax basis in the BU/ stock was $100,000 Included in the sales price was an unrecognited cuatomer list valued at $100,000. The unatocated portion of the purchase price (595.000) will be recorded as goodwat. The corporate-lovel tax of 21 percent apples to 86 as a retut of the transaction. What amount of gain or loss does Emesto recognizo if the trarsacton is structured as a drect asset sae by BLL to Avry and Brian and BLI ditributes the after.tax proceedo to Emesto in fquidation of his slock? QUESTION 10 Same facis as the prior question, ercept Amy and Brian agree to pay 445.000 to purchase all of the BCl sock trom Emesto. What anount of gair or loss does

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts