Question: Pls help me solve this question soon, thanks u so much We suppose the data from Ha Long Co. in the year ussessment 2017 as

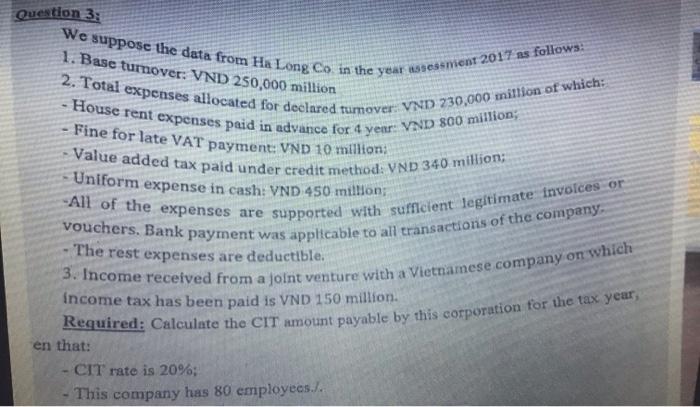

We suppose the data from Ha Long Co. in the year ussessment 2017 as follows: 1. Base turnover: VND 250,000 miltion - House rent expenses paid in advance for 4 year: VND 800 million; - Fine for late VAT payment: VND 10 milition: - Value added tax paid under credit method: VND 340 million; - Uniform expense in cash: VND 450 mitHon: -All of the expenses are supported with sufficient legitimate involces or - The rest expenses are deductible. 3. Income received from a joint venture with a Vietnamese company on which income tax has been paid is VND 150 million. Required: Calculate the CIT amotant payable by this corporation for the tax year, en that: - CIT rate is 20%; - This company has 80 employees

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts