Question: Pls help me with this question Question 5 You are presented with the following summary nancial statements for Small Time Products: INCOME STATEMENT 2019 Sales

Pls help me with this question

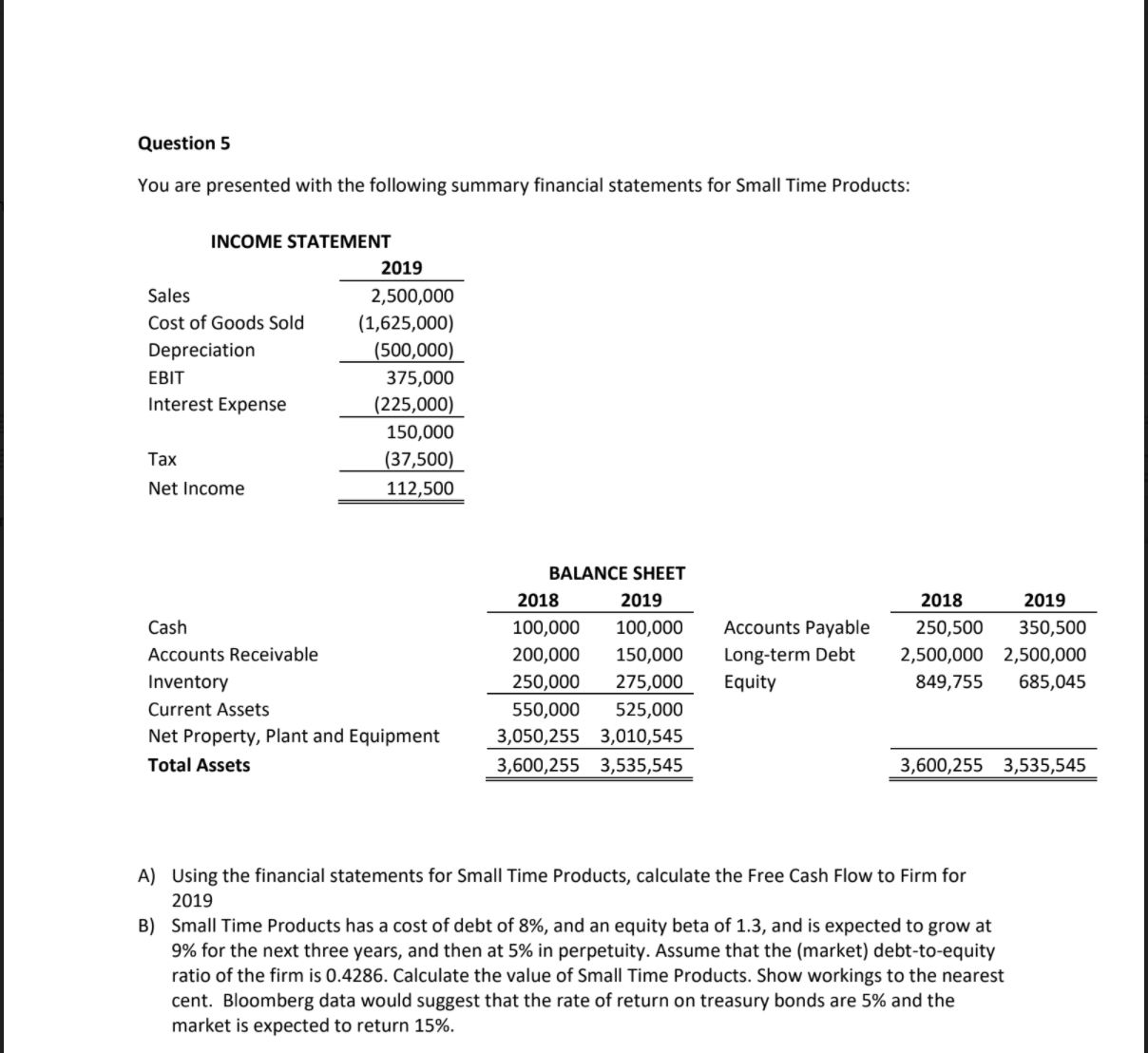

Question 5 You are presented with the following summary nancial statements for Small Time Products: INCOME STATEMENT 2019 Sales 2,500,000 Cost of Goods Sold (1,625,000) Depreciation (500,000) EBIT 375,000 Interest Expense (225,000) 150.000 Tax (37,500) Net Income 112,500 Cash Accounts Receive ble Inventory Current Assets Net Property, Plant and Equipment Total Assets BALANCE SHEET 2018 2019 100,000 100,000 200,000 150,000 250,000 275,000 550,000 525,000 3,050,255 3,010,545 3,600,255 3,535,545 Accounts Payable Long-term Debt Equity 2018 250,500 2,500,000 849,755 3,600,255 A} Using the nancial statements for Small Time Products, calculate the Free Cash Flow to Firm for 2019 B} Small Time Products has a cost of debt of 8%, and an equity beta of 1.3, and is expected to grow at 9% for the next three years, and then at 5% in perpetuity. Assume that the (market! debt-to-equity 2019 350,500 2,500,000 685,045 3.535.545 ratio of the firm is 0.4286. Calculate the value of Small Time Products. Show workings to the nearest cent. Bloomberg data would suggest that the rate of return on treasury bonds are 5% and the market is expected to return 15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts