Question: pls help with Question 3 Question 3 (20 marks) (a) Based on the information given in Question 2 (on pages 8 and 9) for Vetri

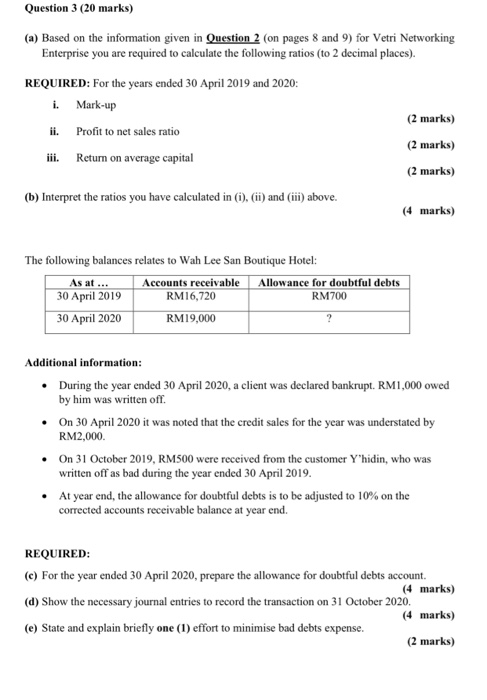

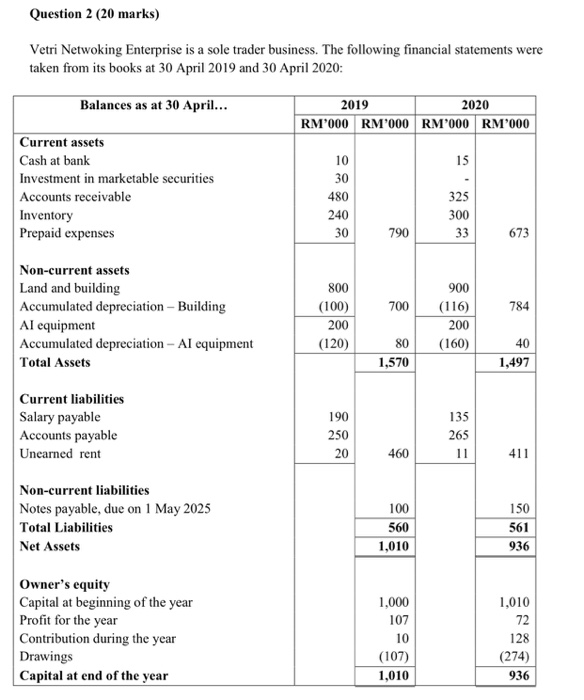

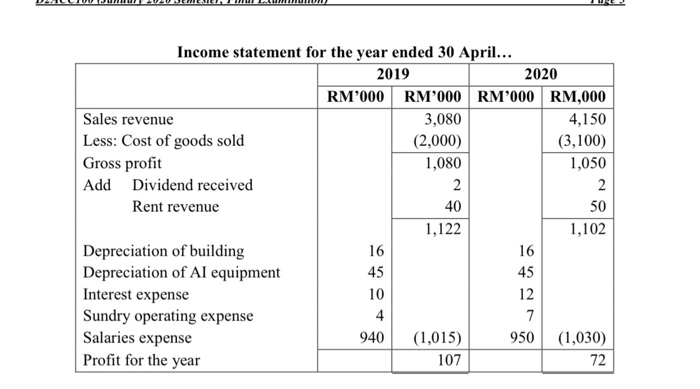

Question 3 (20 marks) (a) Based on the information given in Question 2 (on pages 8 and 9) for Vetri Networking Enterprise you are required to calculate the following ratios (to 2 decimal places). REQUIRED: For the years ended 30 April 2019 and 2020: i. Mark-up (2 marks) ii. Profit to net sales ratio (2 marks) iii. Return on average capital (2 marks) (b) Interpret the ratios you have calculated in (i), (ii) and (iii) above. (4 marks) The following balances relates to Wah Lee San Boutique Hotel: As at... Accounts receivable RM16,720 Allowance for doubtful debts RM700 30 April 2019 30 April 2020 RM19,000 Additional information: During the year ended 30 April 2020, a client was declared bankrupt. RM1,000 owed by him was written ofl. On 30 April 2020 it was noted that the credit sales for the year was understated by RM2,000. On 31 October 2019, RM500 were received from the customer Y'hidin, who was written off as bad during the year ended 30 April 2019. At year end, the allowance for doubtful debts is to be adjusted to 10% on the corrected accounts receivable balance at year end. REQUIRED: (c) For the year ended 30 April 2020, prepare the allowance for doubtful debts account. (4 marks) (d) Show the necessary journal entries to record the transaction on 31 October 2020. (4 marks) (e) State and explain briefly one (1) effort to minimise bad debts expense. (2 marks) Question 2 (20 marks) Vetri Netwoking Enterprise is a sole trader business. The following financial statements were taken from its books at 30 April 2019 and 30 April 2020: Balances as at 30 April... 2019 2020 RM'000 RM'000 RM'000 RM'000 15 Current assets Cash at bank Investment in marketable securities Accounts receivable Inventory Prepaid expenses 325 480 240 300 33 790 673 700 784 Non-current assets Land and building Accumulated depreciation - Building Al equipment Accumulated depreciation - Al equipment Total Assets 800 (100) 200 (120) 900 (116) 200 (160) 80 40 1,497 1,570 190 Current liabilities Salary payable Accounts payable Unearned rent 250 265 460 411 150 Non-current liabilities Notes payable, due on 1 May 2025 Total Liabilities Net Assets 100 560 1,010 936 1,010 72 Owner's equity Capital at beginning of the year Profit for the year Contribution during the year Drawings Capital at end of the year 1,000 107 10 (107) 1,010 128 (274) 936 Income statement for the year ended 30 April... 2019 2020 RM'000 RM'000 RM'000 RM,000 Sales revenue 3,080 4,150 Less: Cost of goods sold (2,000) (3,100) Gross profit 1,080 1,050 Add Dividend received Rent revenue 1.122 1,102 Depreciation of building Depreciation of Al equipment Interest expense 10 Sundry operating expense Salaries expense 940 (1,015) 950 (1,030) Profit for the year 107 72 50 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts