Question: pls show work in excel. also, please clearly state the answer Given a bank loan rate or 9.1%, stock price series and a zero-coupon 5

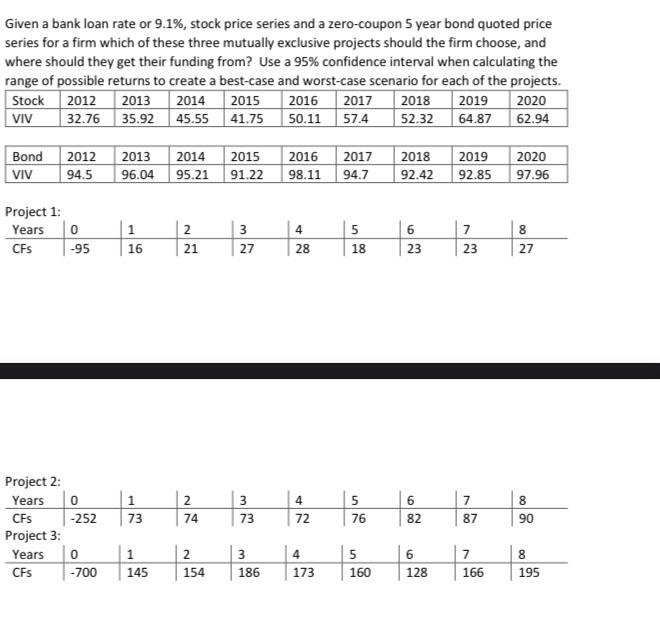

Given a bank loan rate or 9.1%, stock price series and a zero-coupon 5 year bond quoted price series for a firm which of these three mutually exclusive projects should the firm choose, and where should they get their funding from? Use a 95% confidence interval when calculating the range of possible returns to create a best-case and worst-case scenario for each of the projects. Stock 2012 2013 2014 2015 2016 2017 2018 2019 2020 VIV 32.76 35.92 45.55 41.75 50.11 57.4 52.32 64.87 62.94 Bond VIV 2012 94.5 2013 2014 96.04 95.21 2015 91.22 2016 98.11 2017 94.7 2018 92.42 2019 92.85 2020 97.96 Project 1: Years CFS 0 -95 1 16 2 21 3 27 4 28 5 18 6 23 7 23 8 27 2 6 8 1 73 3 73 4 72 5 76 7 87 74 82 90 Project 2: Years o CFS -252 Project 3: Years 0 CFS -700 1 2 5 1 145 2 154 3 186 4 173 6 128 7 166 8 195 160 Given a bank loan rate or 9.1%, stock price series and a zero-coupon 5 year bond quoted price series for a firm which of these three mutually exclusive projects should the firm choose, and where should they get their funding from? Use a 95% confidence interval when calculating the range of possible returns to create a best-case and worst-case scenario for each of the projects. Stock 2012 2013 2014 2015 2016 2017 2018 2019 2020 VIV 32.76 35.92 45.55 41.75 50.11 57.4 52.32 64.87 62.94 Bond VIV 2012 94.5 2013 2014 96.04 95.21 2015 91.22 2016 98.11 2017 94.7 2018 92.42 2019 92.85 2020 97.96 Project 1: Years CFS 0 -95 1 16 2 21 3 27 4 28 5 18 6 23 7 23 8 27 2 6 8 1 73 3 73 4 72 5 76 7 87 74 82 90 Project 2: Years o CFS -252 Project 3: Years 0 CFS -700 1 2 5 1 145 2 154 3 186 4 173 6 128 7 166 8 195 160

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts