Question: Pls solve i dont have much time only 30 min 17) The market risk premium is computed by: A) adding the risk-free rate of return

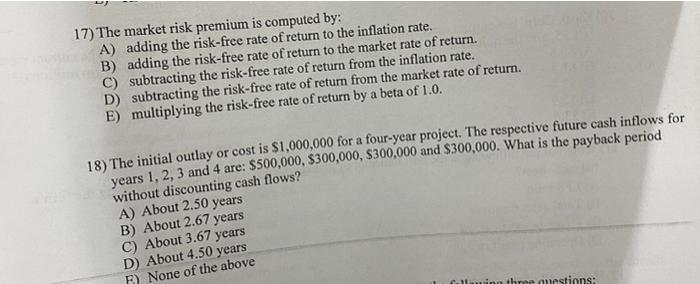

17) The market risk premium is computed by: A) adding the risk-free rate of return to the inflation rate. B) adding the risk-free rate of return to the market rate of return. C) subtracting the risk-free rate of return from the inflation rate. D) subtracting the risk-free rate of return from the market rate of return. E) multiplying the risk-free rate of return by a beta of 1.0. 18) The initial outlay or cost is $1,000,000 for a four-year project. The respective future cash inflows for years 1,2,3 and 4 are: $500,000,$300,000,$300,000 and $300,000. What is the payback period without discounting cash flows? A) About 2.50 years B) About 2.67 years C) About 3.67 years D) About 4.50 years F) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts