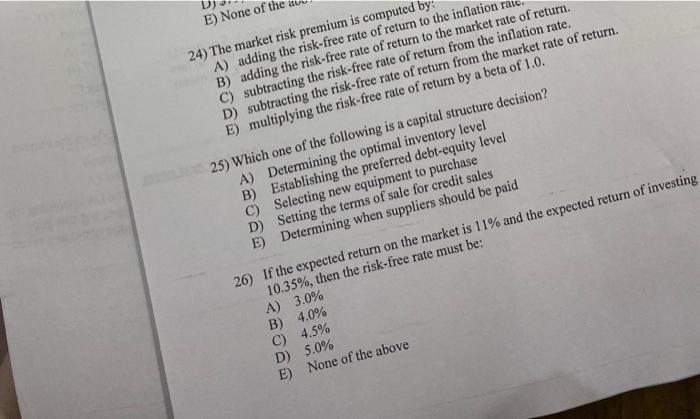

Question: p4 Pls solve i dont have much time only 30 min 24) The market risk premium is computed by: A) adding the risk-free rate of

24) The market risk premium is computed by: A) adding the risk-free rate of returm to the inflation rale. B) adding the risk-free rate of return to the market rate of return. C) subtracting the risk-free rate of ro D) subtracting the risk-free rate of of E) multiplying the risk-free ralc of 25) Which one of the following is a capital structure do level A) Determining the optimal inventory levely level B) Establishing the preferned to purchase C) Selecting new equipment for credit sales D) Setting the terms of sale for credits sald be paid E) Determining when supplers should 26) If the expected return on the market is 11% and be: A) 3.0% B) 4.0% C) 4.5% D) 5.0% E) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts