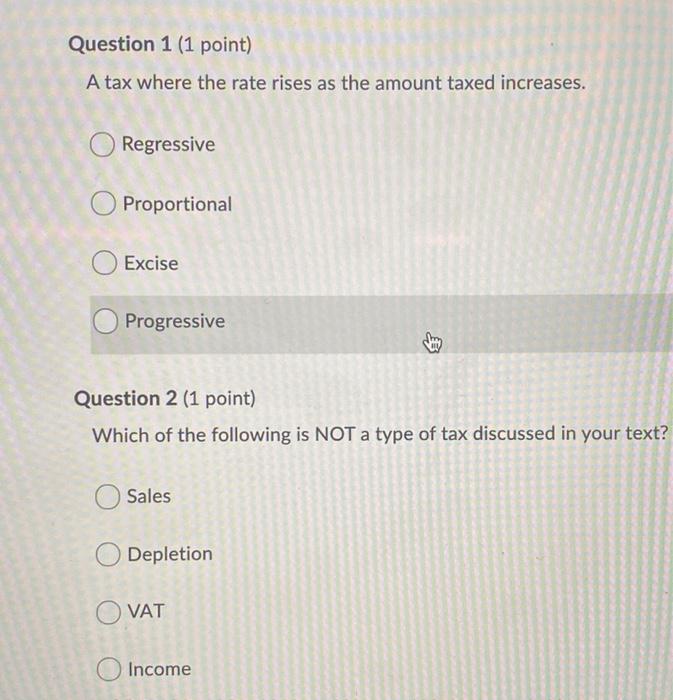

Question: plz answer all 10 :) Question 1 (1 point) A tax where the rate rises as the amount taxed increases. Regressive O Proportional Excise Progressive

plz answer all 10 :)

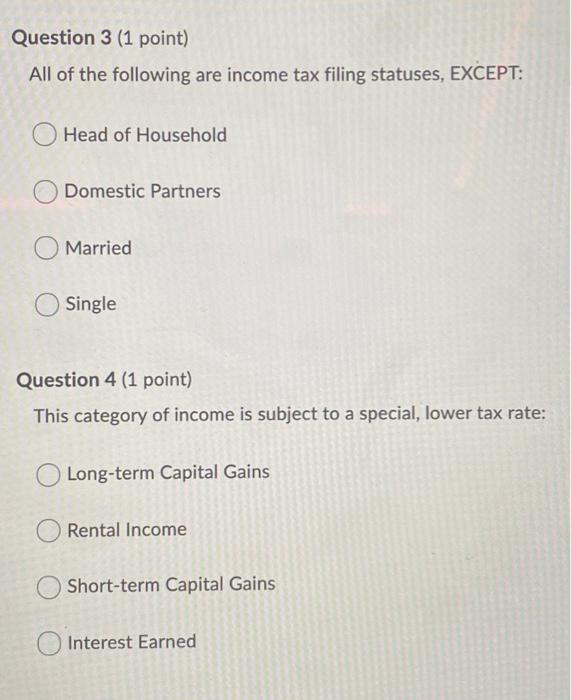

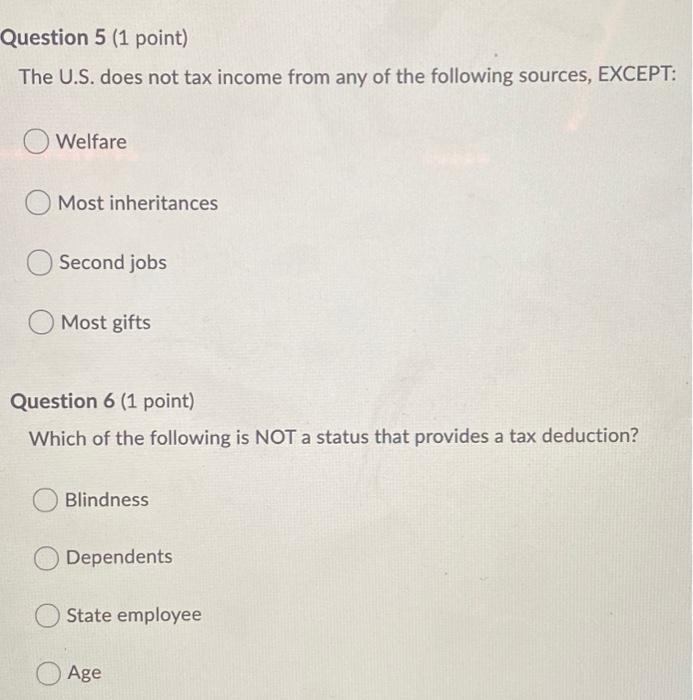

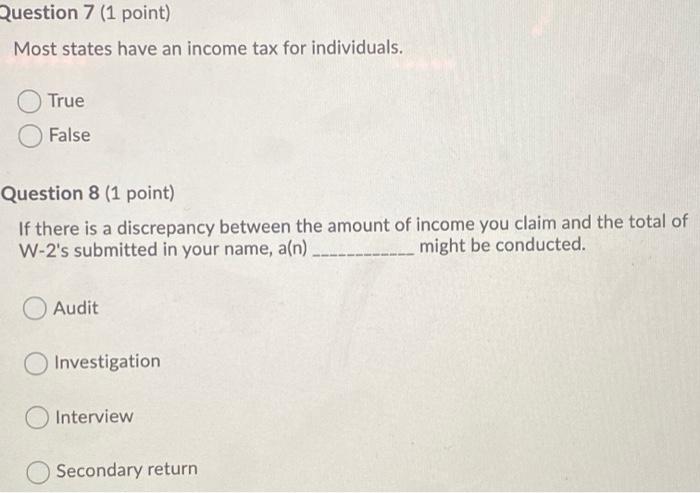

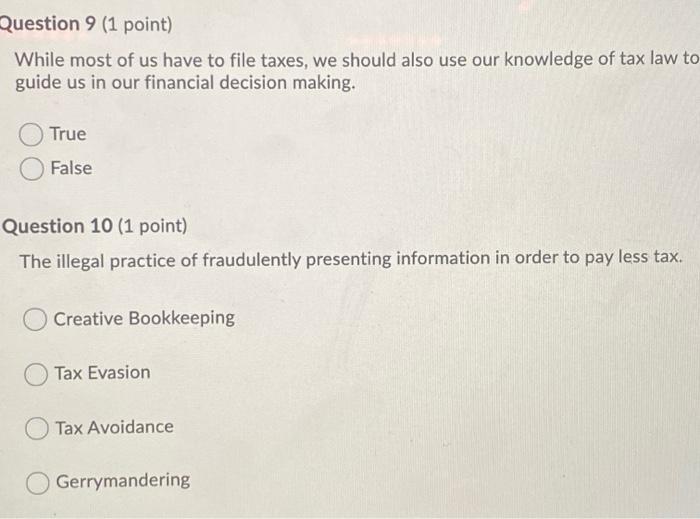

plz answer all 10 :) Question 1 (1 point) A tax where the rate rises as the amount taxed increases. Regressive O Proportional Excise Progressive Question 2 (1 point) Which of the following is NOT a type of tax discussed in your text? Sales Depletion O VAT Income Question 3 (1 point) All of the following are income tax filing statuses, EXCEPT: Head of Household Domestic Partners Married Single Question 4 (1 point) This category of income is subject to a special, lower tax rate: Long-term Capital Gains Rental Income Short-term Capital Gains Interest Earned Question 5 (1 point) The U.S. does not tax income from any of the following sources, EXCEPT: Welfare Most inheritances Second jobs Most gifts Question 6 (1 point) Which of the following is NOT a status that provides a tax deduction? Blindness Dependents State employee Age Question 7 (1 point) Most states have an income tax for individuals. True False Question 8 (1 point) If there is a discrepancy between the amount of income you claim and the total of W-2's submitted in your name, a(n) might be conducted. Audit Investigation Interview Secondary return Question 9 (1 point) While most of us have to file taxes, we should also use our knowledge of tax law to guide us in our financial decision making. True False Question 10 (1 point) The illegal practice of fraudulently presenting information in order to pay less tax. Creative Bookkeeping Tax Evasion Tax Avoidance Gerrymandering

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts