Question: Plz answer all sub-question as a whole question> thans so much. QUESTION 2: Accounting for financial instruments WRITE YOUR ANSWERS TO QUESTION 2 IN THE

Plz answer all sub-question as a whole question> thans so much.

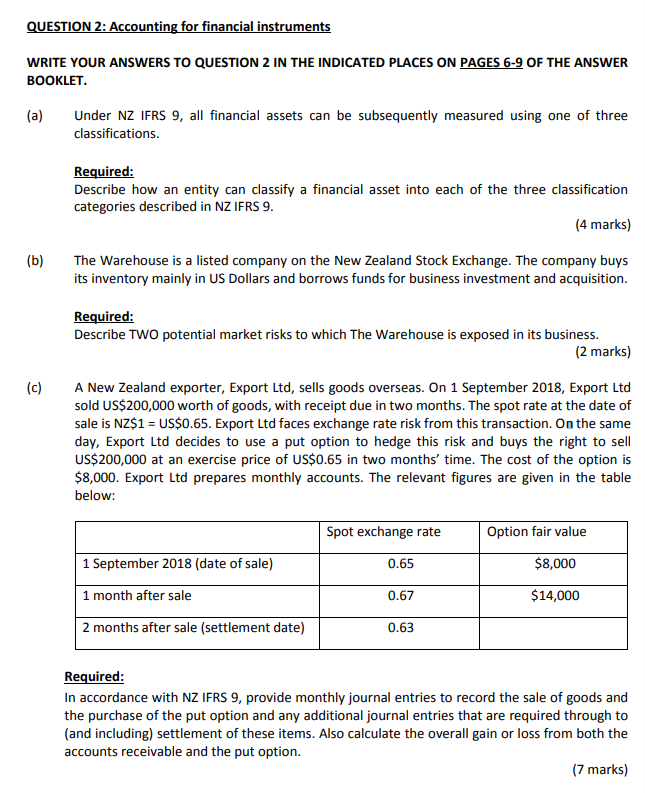

QUESTION 2: Accounting for financial instruments WRITE YOUR ANSWERS TO QUESTION 2 IN THE INDICATED PLACES ON PAGES 6-9 OF THE ANSWER BOOKLET (a) Under NZ IFRS 9, all financial assets can be subsequently measured using one of three classifications Required: Describe how an entity can classify a financial asset into each of the three classification categories described in NZ IFRS 9 (4 marks) (b) The Warehouse is a listed company on the New Zealand Stock Exchange. The company buys its inventory mainly in US Dollars and borrows funds for business investment and acquisition. Required: Describe TWO potential market risks to which The Warehouse is exposed in its business. (2 marks) (c) A New Zealand exporter, Export Ltd, sells goods overseas. On 1 September 2018, Export Ltd sold US$200,000 worth of goods, with receipt due in two months. The spot rate at the date of sale is NZ$1 US$o.65. Export Ltd faces exchange rate risk from this transaction. On the same day, Export Ltd decides to use a put option to hedge this risk and buys the right to sell US$200,000 at an exercise price of US$0.65 in two months' time. The cost of the option is $8,000. Export Ltd prepares monthly accounts. The relevant figures are given in the table below: Spot exchange rate Option fair value $8,000 1 September 2018 (date of sale) 0.65 $14,000 1 month after sale 0.67 2 months after sale (settlement date) 0.63 Required: In accordance with NZ IFRS 9, provide monthly journal entries to record the sale of goods and the purchase of the put option and any additional journal entries that are required through to (and including) settlement of these items. Also calculate the overall gain or loss from both the accounts receivable and the put option (7 marks) QUESTION 2: Accounting for financial instruments WRITE YOUR ANSWERS TO QUESTION 2 IN THE INDICATED PLACES ON PAGES 6-9 OF THE ANSWER BOOKLET (a) Under NZ IFRS 9, all financial assets can be subsequently measured using one of three classifications Required: Describe how an entity can classify a financial asset into each of the three classification categories described in NZ IFRS 9 (4 marks) (b) The Warehouse is a listed company on the New Zealand Stock Exchange. The company buys its inventory mainly in US Dollars and borrows funds for business investment and acquisition. Required: Describe TWO potential market risks to which The Warehouse is exposed in its business. (2 marks) (c) A New Zealand exporter, Export Ltd, sells goods overseas. On 1 September 2018, Export Ltd sold US$200,000 worth of goods, with receipt due in two months. The spot rate at the date of sale is NZ$1 US$o.65. Export Ltd faces exchange rate risk from this transaction. On the same day, Export Ltd decides to use a put option to hedge this risk and buys the right to sell US$200,000 at an exercise price of US$0.65 in two months' time. The cost of the option is $8,000. Export Ltd prepares monthly accounts. The relevant figures are given in the table below: Spot exchange rate Option fair value $8,000 1 September 2018 (date of sale) 0.65 $14,000 1 month after sale 0.67 2 months after sale (settlement date) 0.63 Required: In accordance with NZ IFRS 9, provide monthly journal entries to record the sale of goods and the purchase of the put option and any additional journal entries that are required through to (and including) settlement of these items. Also calculate the overall gain or loss from both the accounts receivable and the put option (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts