Question: Plz answer all sub-question as a whole. Thanks so much. QUESTION 5: Accounting for income tax WRITE YOUR ANSWERS TO QUESTION 5 IN THE INDICATED

Plz answer all sub-question as a whole. Thanks so much.

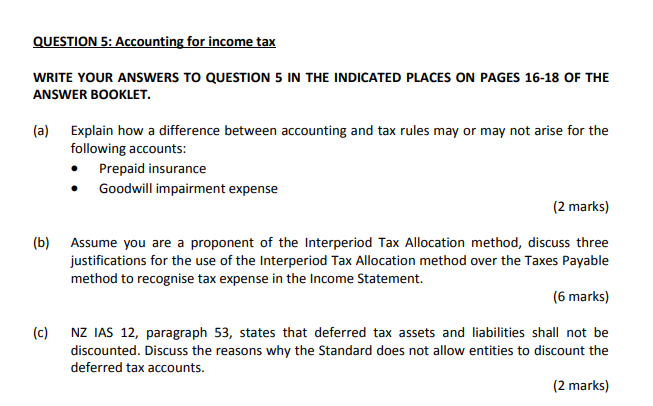

QUESTION 5: Accounting for income tax WRITE YOUR ANSWERS TO QUESTION 5 IN THE INDICATED PLACES ON PAGES 16-18 OF THE ANSWER BOOKLET. (a) Explain how a difference between accounting and tax rules may or may not arise for the following accounts: Prepaid insurance Goodwill impairment expense (2 marks) (b) Assume you are a proponent of the Interperiod Tax Allocation method, discuss three justifications for the use of the Interperiod Tax Allocation method over the Taxes Payable method to recognise tax expense in the Income Statement (6 marks) (c) NZ IAS 12, paragraph 53, states that deferred tax assets and liabilities shall not be discounted. Discuss the reasons why the Standard does not allow entities to discount the deferred tax accounts. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts