Question: plz answer the following question based on the information has been provided especially for 7-8 use the summary output. thank you lultiple Regression 1) State

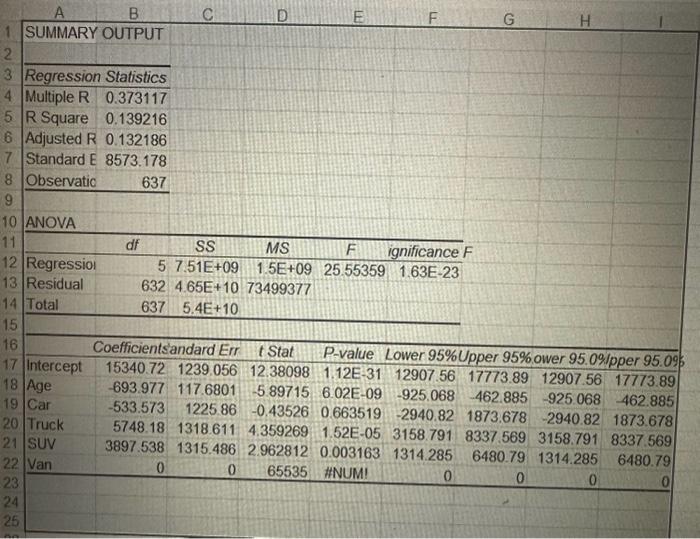

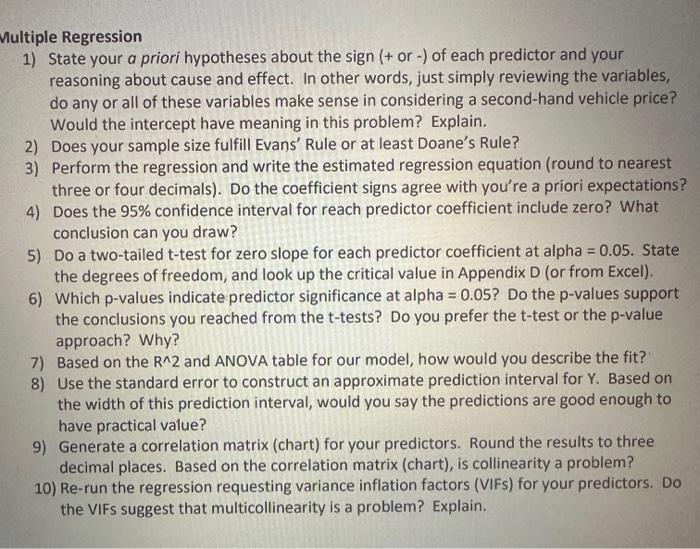

lultiple Regression 1) State your a priori hypotheses about the sign (+ or -) of each predictor and your reasoning about cause and effect. In other words, just simply reviewing the variables, do any or all of these variables make sense in considering a second-hand vehicle price? Would the intercept have meaning in this problem? Explain. 2) Does your sample size fulfill Evans' Rule or at least Doane's Rule? 3) Perform the regression and write the estimated regression equation (round to nearest three or four decimals). Do the coefficient signs agree with you're a priori expectations? 4) Does the 95% confidence interval for reach predictor coefficient include zero? What conclusion can you draw? 5) Do a two-tailed t-test for zero slope for each predictor coefficient at alpha =0.05. State the degrees of freedom, and look up the critical value in Appendix D (or from Excel). 6) Which p-values indicate predictor significance at alpha =0.05 ? Do the p-values support the conclusions you reached from the t-tests? Do you prefer the t-test or the p-value approach? Why? 7) Based on the R2 and ANOVA table for our model, how would you describe the fit? 8) Use the standard error to construct an approximate prediction interval for Y. Based on the width of this prediction interval, would you say the predictions are good enough to have practical value? 9) Generate a correlation matrix (chart) for your predictors. Round the results to three decimal places. Based on the correlation matrix (chart), is collinearity a problem? 10) Re-run the regression requesting variance inflation factors (VIFs) for your predictors. Do the VIFs suggest that multicollinearity is a problem? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts