Question: plz only answer if you know how to solve w steps!! thank you guys! Question 1 0/1 pts You are attempting to build a portfolio

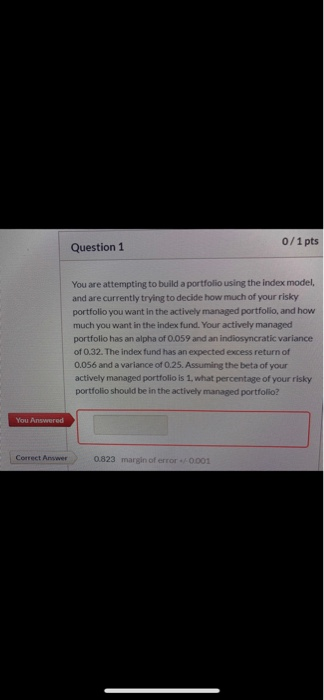

Question 1 0/1 pts You are attempting to build a portfolio using the index model, and are currently trying to decide how much of your risky portfolio you want in the actively managed portfolio, and how much you want in the index fund. Your actively managed portfolio has an alpha of 0.059 and an indiosyncratic variance of 0.32. The index fund has an expected excess return of 0.056 and a variance of 0.25. Assuming the beta of your actively managed portfolio is 1. what percentage of your risky portfolio should be in the actively managed portfolio You Answered Correct Answer 0823 margin of error -0.001 Question 1 0/1 pts You are attempting to build a portfolio using the index model, and are currently trying to decide how much of your risky portfolio you want in the actively managed portfolio, and how much you want in the index fund. Your actively managed portfolio has an alpha of 0.059 and an indiosyncratic variance of 0.32. The index fund has an expected excess return of 0.056 and a variance of 0.25. Assuming the beta of your actively managed portfolio is 1. what percentage of your risky portfolio should be in the actively managed portfolio You Answered Correct Answer 0823 margin of error -0.001

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts