Question: this is everything they habe given Question 2 0/1 pts You are attempting to build a portfolio using the index model, and are currently trying

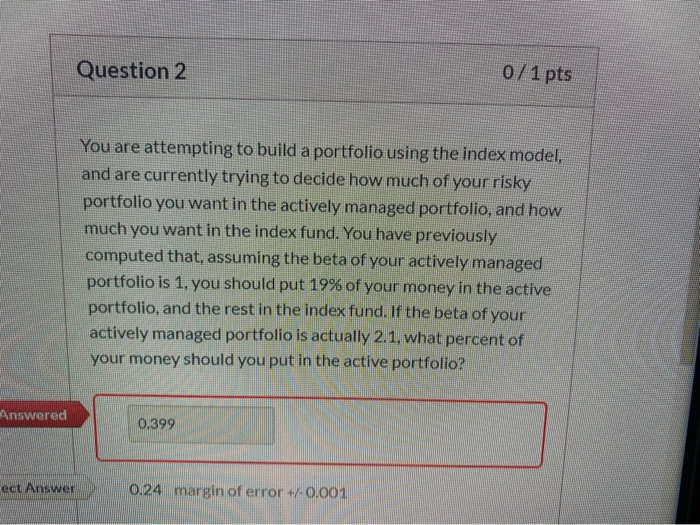

Question 2 0/1 pts You are attempting to build a portfolio using the index model, and are currently trying to decide how much of your risky portfolio you want in the actively managed portfolio, and how much you want in the index fund. You have previously computed that, assuming the beta of your actively managed portfolio is 1, you should put 19% of your money in the active portfolio, and the rest in the index fund. If the beta of your actively managed portfolio is actually 2.1, what percent of your money should you put in the active portfolio? Answered 0.399 ect Answer 0.24 margin of error +/-0.001 Question 2 0/1 pts You are attempting to build a portfolio using the index model, and are currently trying to decide how much of your risky portfolio you want in the actively managed portfolio, and how much you want in the index fund. You have previously computed that, assuming the beta of your actively managed portfolio is 1, you should put 19% of your money in the active portfolio, and the rest in the index fund. If the beta of your actively managed portfolio is actually 2.1, what percent of your money should you put in the active portfolio? Answered 0.399 ect Answer 0.24 margin of error +/-0.001

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts