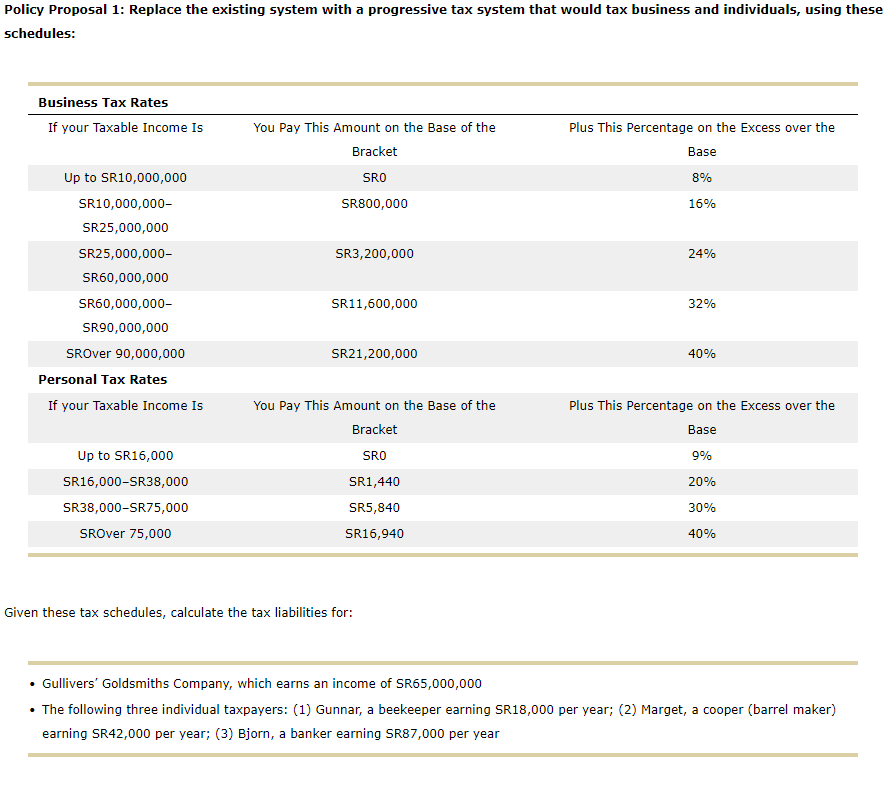

Question: Policy Proposal 1: Replace the existing system with a progressive tax system that would tax business and individuals, using these schedules: Business Tax Rates If

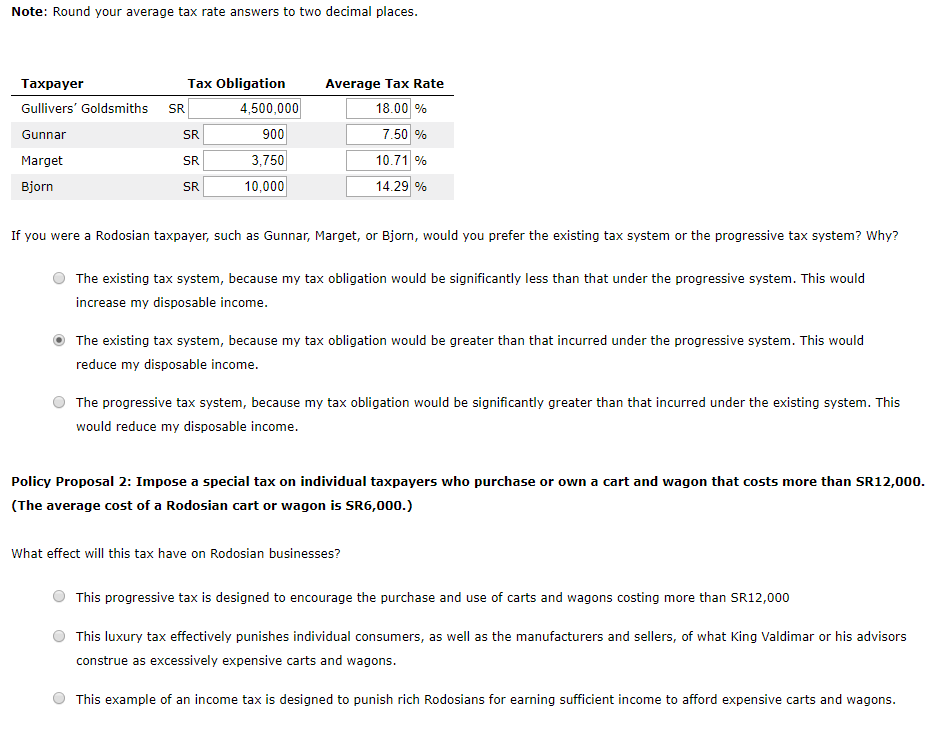

Policy Proposal 1: Replace the existing system with a progressive tax system that would tax business and individuals, using these schedules: Business Tax Rates If your Taxable Income Is Plus This Percentage on the Excess over the Base You Pay This Amount on the Base of the Bracket SRO SR800,000 8% Up to SR10,000,000 SR10,000,000- SR25,000,000 16% SR3,200,000 24% SR11,600,000 32% SR25,000,000- SR60,000,000 SR60,000,000- SR90,000,000 SROver 90,000,000 Personal Tax Rates If your Taxable Income Is SR21,200,000 40% You Pay This Amount on the Base of the Bracket Plus This Percentage on the Excess over the Base SRO 9% SR1,440 20% Up to SR16,000 SR16,000-SR38,000 SR38,000-SR75,000 SROver 75,000 30% SR5,840 SR16,940 40% Given these tax schedules, calculate the tax liabilities for: Gullivers' Goldsmiths Company, which earns an income of SR65,000,000 The following three individual taxpayers: (1) Gunnar, a beekeeper earning SR18,000 per year; (2) Marget, a cooper (barrel maker) earning SR42,000 per year; (3) Bjorn, a banker earning SR87,000 per year Note: Round your average tax rate answers to two decimal places. Taxpayer Gullivers' Goldsmiths Gunnar Tax Obligation SR 4,500,000 SR900 3,750 10,000 Average Tax Rate 18.00 % 7.50 % 10.71 % 14.29% Marget Bjorn If you were a Rodosian taxpayer, such as Gunnar, Marget, or Bjorn, would you prefer the existing tax system or the progressive tax system? Why? The existing tax system, because my tax obligation would be significantly less than that under the progressive system. This would increase my disposable income. The existing tax system, because my tax obligation would be greater than that incurred under the progressive system. This would reduce my disposable income. The progressive tax system, because my tax obligation would be significantly greater than that incurred under the existing system. This would reduce my disposable income. Policy Proposal 2: Impose a special tax on individual taxpayers who purchase or own a cart and wagon that costs more than SR12,000. (The average cost of a Rodosian cart or wagon is SR6,000.) What effect will this tax have on Rodosian businesses? O This progressive tax is designed to encourage the purchase and use of carts and wagons costing more than SR12,000 This luxury tax effectively punishes individual consumers, as well as the manufacturers and sellers, of what King Valdimar or his advisors construe as excessively expensive carts and wagons. This example of an income tax is designed to punish rich Rodosians for earning sufficient income to afford expensive carts and wagons

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts