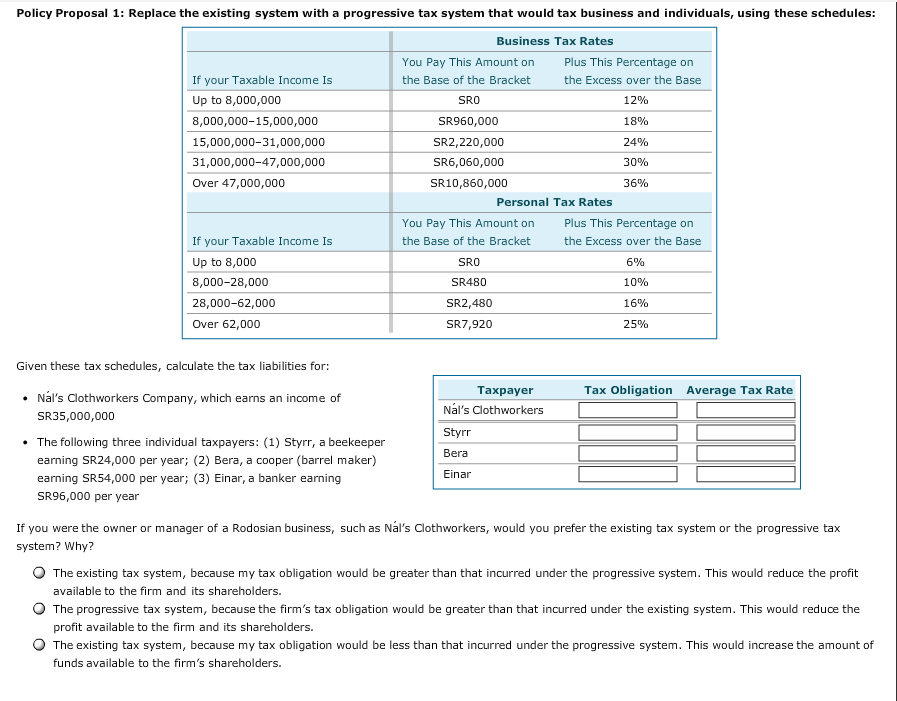

Question: Replace the existing system with a progressive tax system that would tax business and individuals, using these schedules: Given these tax schedules, calculate the tax

Replace the existing system with a progressive tax system that would tax business and individuals, using these schedules: Given these tax schedules, calculate the tax liabilities for: Nal's Clothworkers Company, which earns an income of SR35,000,000 The following three individual taxpayers: (1) Styrr, a beekeeper earning SR24,000 per year; (2) Bera, a cooper (barrel maker) earning SR54,000 per year; (3) Einar, a banker earning SR96,000 per year If you were the owner or manager of a Rodosian business, such as Nal's Clothworkers, would you prefer the existing tax system or the progressive tax system? Why? The existing tax system, because my tax obligation would be greater than that incurred under the progressive system. This would reduce the profit available to the firm and its shareholders. The progressive tax system, because the firm's tax obligation would be greater than that incurred under the existing system. This would reduce the profit available to the firm and its shareholders. The existing tax system, because my tax obligation would be less than that incurred under the progressive system. This would increase the amount of funds available to the firm's shareholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts