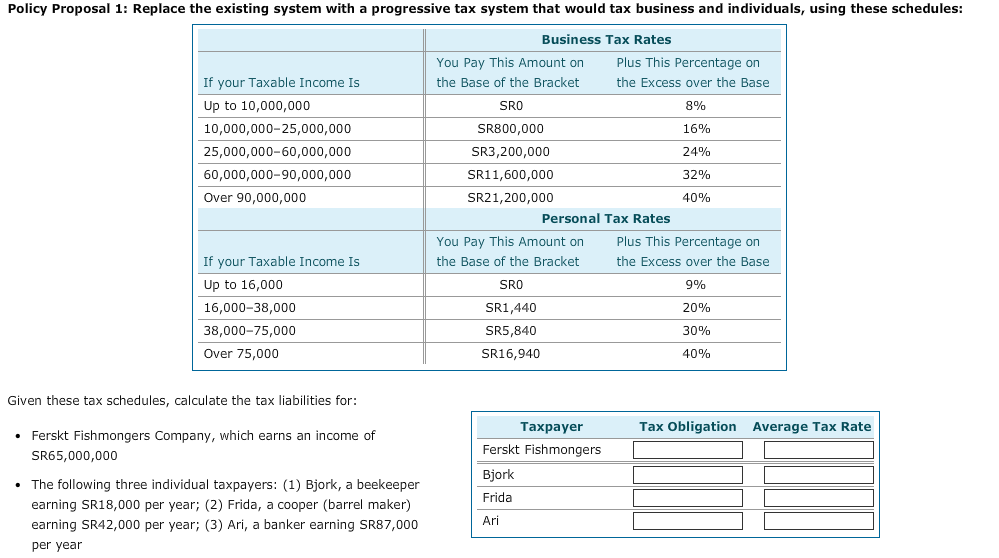

Question: Policy Proposal 1: Replace the existing system with a progressive tax system that would tax business and individuals, using these schedules: Business Tax Rates You

Policy Proposal 1: Replace the existing system with a progressive tax system that would tax business and individuals, using these schedules: Business Tax Rates You Pay This Amount on the Base of the Bracket SRO SR800,000 SR3,200,000 SR11,600,000 SR21,200,000 Plus This Percentage on If your Taxable Income Is Up to 10,000,000 10,000,000-25,000,000 25,000,000-60,000,000 60,000,000-90,000,000 Over 90,000,000 the Excess over the Base 8% 16% 24% 32% 40% Personal Tax Rates You Pay This Amount on the Base of the Bracket SRO SR1,440 SR5,840 SR16,940 Plus This Percentage on If your Taxable Income Is Up to 16,000 16,000-38,000 38,000-75,000 Over 75,000 the Excess over the Base 9% 20% 30% 40% Given these tax schedules, calculate the tax liabilities for: Taxpayer Tax Obligation Average Tax Rate . Ferskt Fishmongers Company, which earns an income of Ferskt Fishmongers Bjork Frida Ari SR65,000,000 . The following three individual taxpayers: (1) Bjork, a beekeeper earning SR18,000 per year; (2) Frida, a cooper (barrel maker) earning SR42,000 per year; (3) Ari, a banker earning SR87,000 per year Assume that Bjork owes the same tax liability under both the current tax system and the proposed (progressive) system. As an economically rational taxpayer, why should he prefer the current system? Because under the current system the next sodor earned would be taxed at the rate of 1.2%; under the progressive system, it would not be subject to any tax. exempt from additional taxes. to any tax O Because under the progressive tax system the next sodor earned would be taxed at the highest tax rate 40% unde, the current system, would be 0 Because under the progressive tax system the next sodor earned would be taxed at the rate of 10%; under the current system, it would not be subject Policy Proposal 2: Assess a special tax on businesses that own more than 10 horses or oxen What effect will this tax have on Rodosian businesses? The tax will not affect the businesses being assessed the tax or the Treasury's tax revenues. This is an example of a sin tax. O This tax on more than 10 horses or oxen has the potential to penalize businesses from growing beyond a certain level. This will reduce the Treasury's tax revenues and potentially limit the growth potential and sales of businesses that provide goods and services to the taxpayers being assessed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts