Portfolio 1 consists of two risky assets A and B with the following characteristics E(rA) =...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

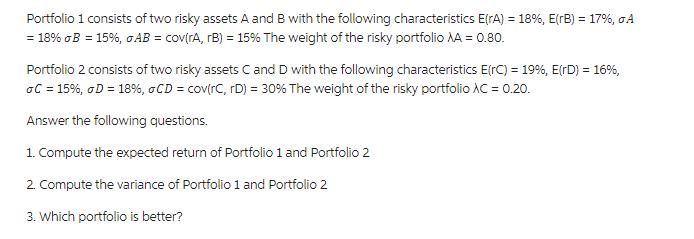

Portfolio 1 consists of two risky assets A and B with the following characteristics E(rA) = 18%, E(rB) = 17%, σA = 18% GB = 15%, σAB = cov(rA, rB) = 15% The weight of the risky portfolio A = 0.80. Portfolio 2 consists of two risky assets C and D with the following characteristics E(rC) = 19%, E(rD) = 16%, oC = 15%, D = 18%, o CD = cov(rC, rD) = 30% The weight of the risky portfolio XC = 0.20. Answer the following questions. 1. Compute the expected return of Portfolio 1 and Portfolio 2 2. Compute the variance of Portfolio 1 and Portfolio 2 3. Which portfolio is better? Portfolio 1 consists of two risky assets A and B with the following characteristics E(rA) = 18%, E(rB) = 17%, σA = 18% GB = 15%, σAB = cov(rA, rB) = 15% The weight of the risky portfolio A = 0.80. Portfolio 2 consists of two risky assets C and D with the following characteristics E(rC) = 19%, E(rD) = 16%, oC = 15%, D = 18%, o CD = cov(rC, rD) = 30% The weight of the risky portfolio XC = 0.20. Answer the following questions. 1. Compute the expected return of Portfolio 1 and Portfolio 2 2. Compute the variance of Portfolio 1 and Portfolio 2 3. Which portfolio is better?

Expert Answer:

Answer rating: 100% (QA)

1 Expected return of Portfolio 1 Erp1 A ErA 1 A ErB Erp1 080 18 020 17 Erp1 178 Expected return of P... View the full answer

Related Book For

Modeling the Dynamics of Life Calculus and Probability for Life Scientists

ISBN: 978-0840064189

3rd edition

Authors: Frederick R. Adler

Posted Date:

Students also viewed these accounting questions

-

Which one of the following statement is NOT correct? O If you know the correlation parameter between rA and rB and their standard deviation measures, then you can also pin down the covariance between...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-6. On December 12, Irene purchased the building where her store is located. She paid...

-

A partially completed flowchart showing some of the major documents commonly used in the purchasing function of a merchandise business is presented below. Identify documents 1, 3, and4. Purchase Order

-

Given the following highway rerouting project, (a) Draw the network. (b) Find the ESs, LSs, and slacks. (c) Find the critical path. (d) If the project has a 1 1/2-year deadline for reopening, should...

-

Wayne A. Long, Sergio Lopez, and Don Bannister entered into a partnership agreement in which they formed Wood Relo (the partnership). The three partners agreed to share equally one-third of the...

-

The stress-strain diagram for a material can be approximated by the two line segments. If a bar having a diameter of \(80 \mathrm{~mm}\) and a length of \(1.5 \mathrm{~m}\) is made from this...

-

The following cost data relate to the manufacturing activities of Chang Company during the just completed year: The company uses a predetermined overhead rate to apply overhead cost to production....

-

Explore the challenges of data sharing in multi-threaded programming. What techniques can be used to ensure safe data access across threads, and how does thread-local storage contribute to solving...

-

Golden Corporation's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable...

-

On 11/1/2020, your company recorded the following journal entries: DR: Cash .. $5,000 CR: Deferred Revenue $ 5,000 *** .. What is the impact of these journal entries on the financial statement ratios...

-

Steve and Brenda Edwards, both graduate students, moved into an apartment near the university. Brenda wants to buy renters insurance, but Steve thinks they dont need it because their furniture isnt...

-

The file named Baseball96.xlsx gives the runs scored, singles, doubles, triples, home runs, and bases stolen for each Major League Baseball team during the 1996 season. Use this data to determine the...

-

Sketch the magnitude and direction of the heat flux under the ground driven by annual temperature variations as a function of depth for the four times of the year shown in Figure. 25 20E midsummer 15...

-

Create a Ts diagram for Problem 9.125 using the NIST software plotting capability. Your sketch should show the following: A. The vapor dome B. Constant-temperature lines (isotherms) for 10, 20, 95,...

-

a) Use the SRK equation of state to calculate the saturation pressure of ethane at 58.5 C. b) Use the SRK equation to construct the PV graph of ethane. Show isotherms at T = 58.5 K and T = T c .

-

a. What is the overall profit if all intermediate products are processed into final products? Overall profit from processing all intermediate products b. What is the financial advantage...

-

Write an essay describing the differing approaches of nursing leaders and managers to issues in practice. To complete this assignment, do the following: 1. Select an issue from the following list:...

-

Twenty events occur in 1 min with a given value of A = 10.0. Check whether the given value of A lies within the approximate 95% confidence limits given by the method of support.

-

(From Section 7.1, Exercises 2 and 6) For the following joint distributions, find the probabilities for the random variable X + Y and check that E(X + Y) = E(X) + E(Y). Y=1 0.45 0.25 r=3 0.05 0.25

-

90% confidence limits around the height H in Exercise 2. Find the given confidence limits around the sample mean for the given measurement, assuming that the sample variance s is a good estimate of...

-

A dynamic absorber is to be designed to eliminate the vibration at coordinate \(x_{1}\) for the system shown in Fig. P5.6, where the excitation frequency is \(400 \mathrm{rad} / \mathrm{s}\) and the...

-

After installation, it was found that a particular machine exhibited excessive vibration due to a harmonic excitation force with a frequency of \(100 \mathrm{~Hz}\). A dynamic absorber was designed...

-

Given the eigenvalues and eigenvectors for the two degree of freedom system shown in Fig. P5.9, complete the following. \[\begin{array}{ll} s_{1}^{2}=-1 \times 10^{6} \mathrm{rad} / \mathrm{s}^{2} &...

Study smarter with the SolutionInn App