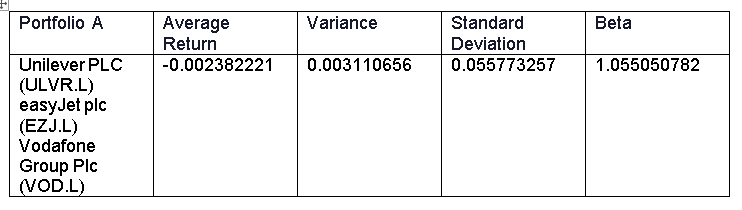

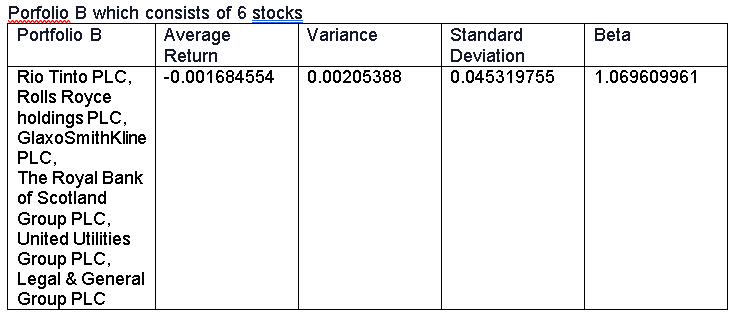

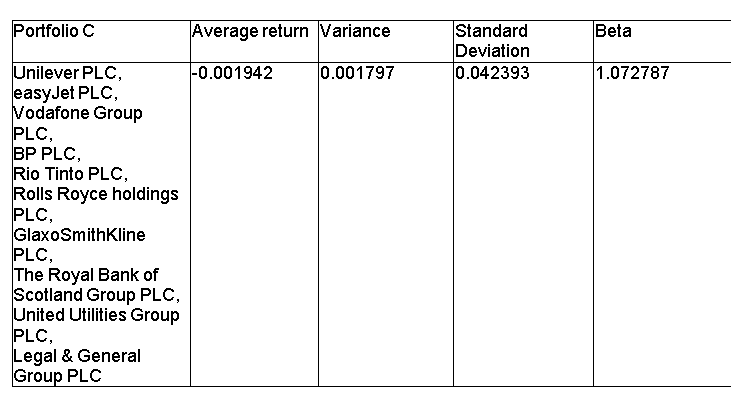

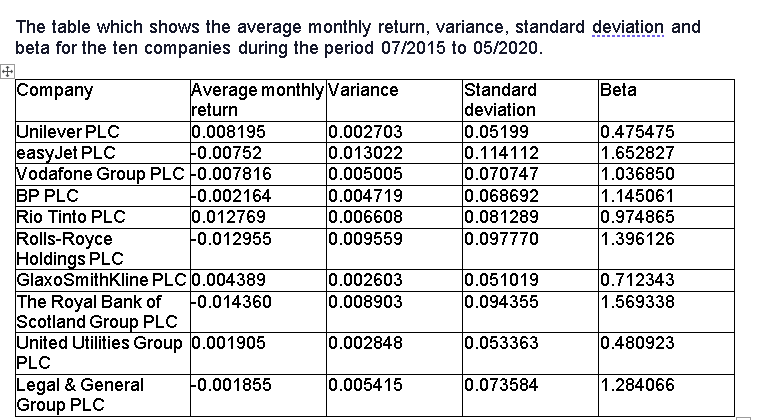

Question: Portfolio A Average Variance Standard Beta Return Deviation Unilever PLC 0.002382221 0.003110656 0.055773257 1.055050782 (ULVR.L) easy Jet plc (EZJ.L) Vodafone Group Plc (VOD.L)Porfolio B which

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock