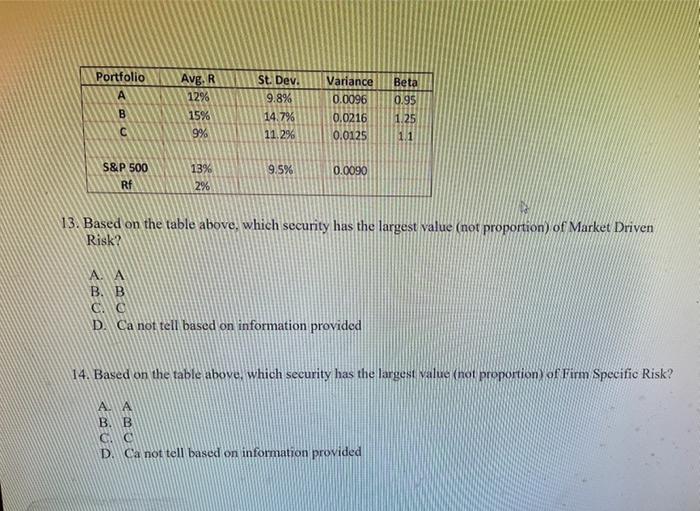

Question: Portfolio A Avg. R 12% 15% 9% St Dev. 9.8% 14.7% 11.2% Variance 0.0096 0.0216 0.0125 Beta 0.95 1.25 B C 11 S&P 500 9.5%

Portfolio A Avg. R 12% 15% 9% St Dev. 9.8% 14.7% 11.2% Variance 0.0096 0.0216 0.0125 Beta 0.95 1.25 B C 11 S&P 500 9.5% 0.0090 13% 2% Rf 13. Based on the table above, which security has the largest value (not proportion) of Market Driven Risk? . . B. B D. Ca not tell based on information provided 14. Based on the table above, which security has the largest Value (not proportion of Firm Specific Risk? AA . D. Ca not tell based on information provided

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock